Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Our offices will be closed on Monday, January 20, 2025 to observe Martin Luther King Jr Day. We will resume regular business hours on Tuesday, January 21, 2025.

Clients can visit myEQUITY at any time to see status updates, submit new requests, and receive up-to-date information regarding accounts.

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

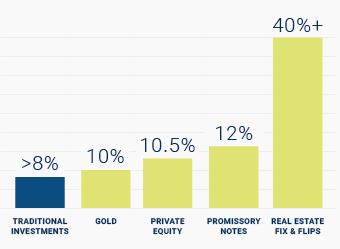

A self-directed account enables you to diversify into alternative assets that have historically outperformed traditional investments, while allowing you to maintain your desired mix of traditional and alternative assets. Talk to an IRA Counselor and discover the many self-directed IRA investment options.

Changing your strategy to include investments beyond traditional assets can dramatically expand your horizons, both from a return-on-investment and diversification perspective. Explore how assets like real estate, private equity, and precious metals can redefine your retirement planning.

What are you investing for? Whether your “why” is retirement, healthcare expenses, or a loved one’s education, we make the journey easy with innovative technology and first-class service.

Access your exclusive, free guide for an extensive list of investment options for your account, plus how to get started.

Browse the tax–advantaged accounts and find one that matches your savings goals – from retirement to education to health care savings.

Discover what you need to know before you make your first investment, including investments not allowed in an IRA and how much you can contribute to your account.

Ready to Get Started?

Our knowledgeable IRA Counselors can answer your questions about the self-directed investing process and share insight and education about our self-directed accounts to help you decide what options may be best for you.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue