200+

Dealers on

Platform

$7.2B

Precious Metals Assets

Under Custody

& Administration**

50+

Years in the

Financial

Services

Industry*

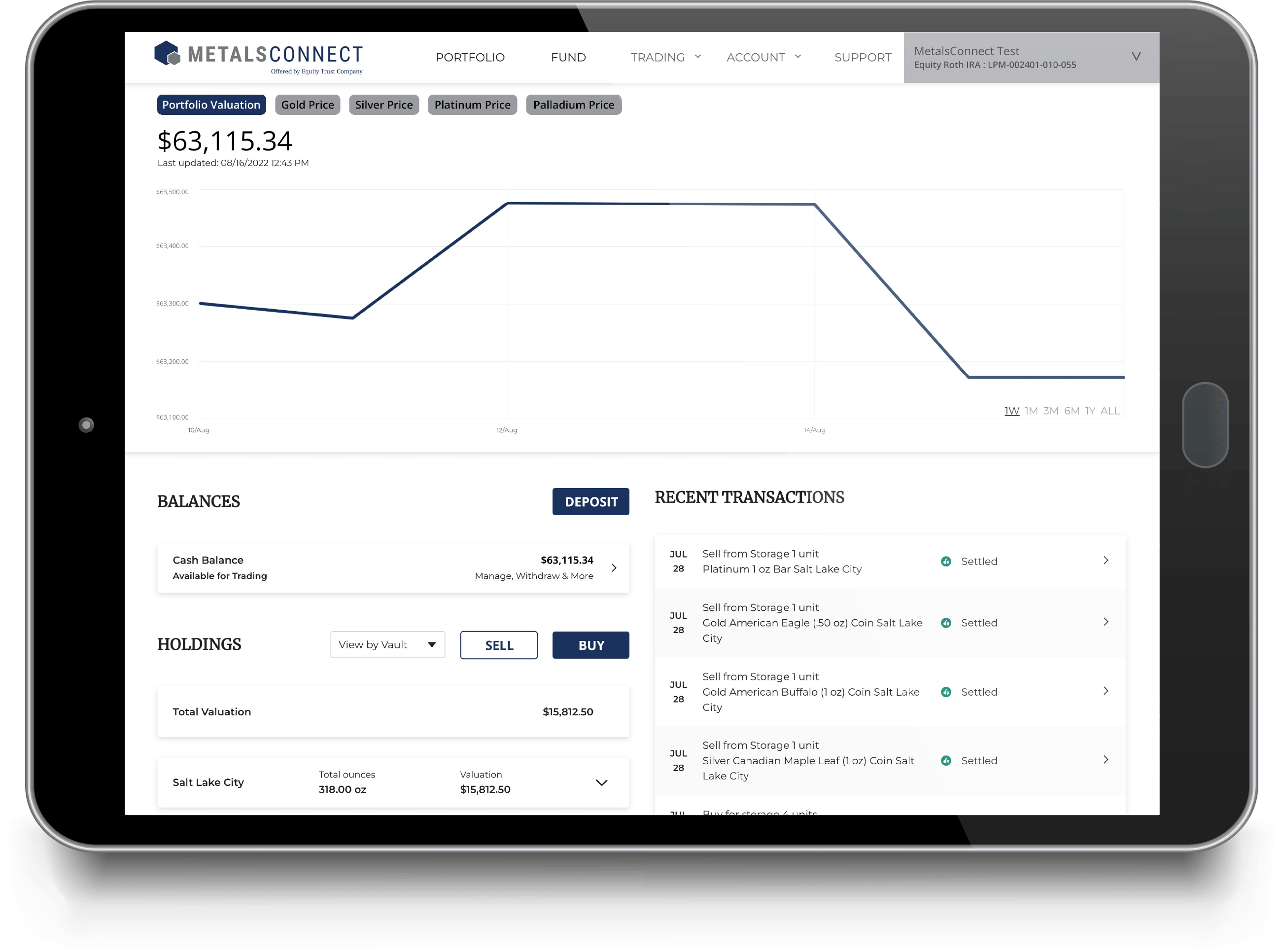

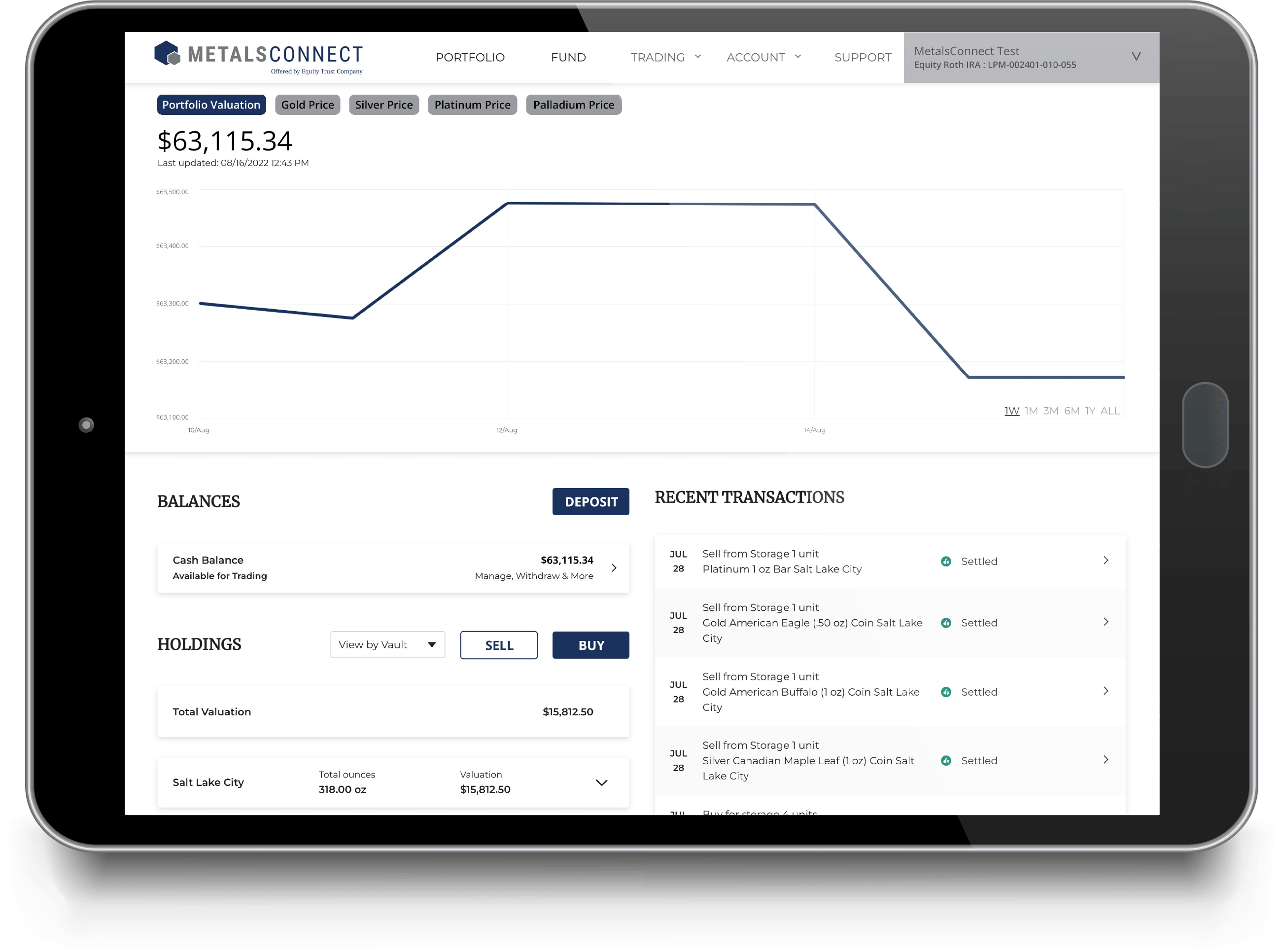

METALSCONNECT

Simplified Precious

Metals Investing

It has never been easier to connect investors with opportunities in precious metals. MetalsConnect provides you with a one-stop solution to easily open, fund, manage, and settle investments in IRAs and non-IRA accounts, all in one place.

A state-of-the-art, turnkey solution designed for dealers interested in providing their clients with access to the world of precious metals, MetalsConnect allows dealers to:

- Reach customers with a broker-friendly platform

- Automate tedious, time-consuming back-office tasks

- Electronically connect to a custodian (Equity Trust), wholesalers, and storage providers

- Seamlessly integrate into an existing platform

A Solution for All Investor Models

MetalsConnect accommodates your preferred method of doing business:

ECOMMERCE

LIQUIDITY

TELEPHONE SALES

SHIPPING LOGISTICS AND VAULTING

Depository Options

We offer a variety of options for secure storage of precious metals. Equity Institutional and our metals platform provider partner Gold Bullion International (GBI) work with depositories in locations spanning the globe.

Equity Institutional: A Leader in Precious Metals IRAs

Whether you choose to integrate with MetalsConnect or take a more traditional approach to transactions, Equity Institutional has the experience and knowledge to support your business.

Ease of Use for Clients: myEQUITY

Provide your clients with a simplified account-open process and easy account management.

Transaction Speed

We maintain a one-business day turnaround on typical purchase transactions.

Safe, Secure Storage of Assets

We work with several approved metals depository facilities and locations across the country, each licensed for secure storage of gold, silver, platinum, and palladium.

Australian Perth Mint Certificate Program

Equity Trust is an approved custodian to hold Australian Perth Mint Certificates within an investor’s account.

Industry-Leading Service

You work directly with your experienced, dedicated Relationship Manager for a personal and direct point of contact.

Simple Fee Schedule and Flat-Fee Storage

Your IRA investors will appreciate the flat fee schedules offered, including a flat fee for storage, regardless of account value.

Variety of Metals Options

Flexibility to invest in a wide variety of precious metals — including gold and silver American Eagle coins and other gold, silver, palladium, platinum coins, and bullion.

Established, Leading Custodian

Equity Trust Company has 50+ years of experience in the financial services industry and was named Best Overall Self-Directed IRA Company by Investopedia from 2020-2024.

Ease of Use for Clients: myEQUITY

Transaction Speed

Safe, Secure Storage of Assets

Australian Perth Mint Certificate Program

Industry-Leading Service

Simple Fee Schedule and Flat-Fee Storage

Variety of Metals Options

Established, Leading Custodian

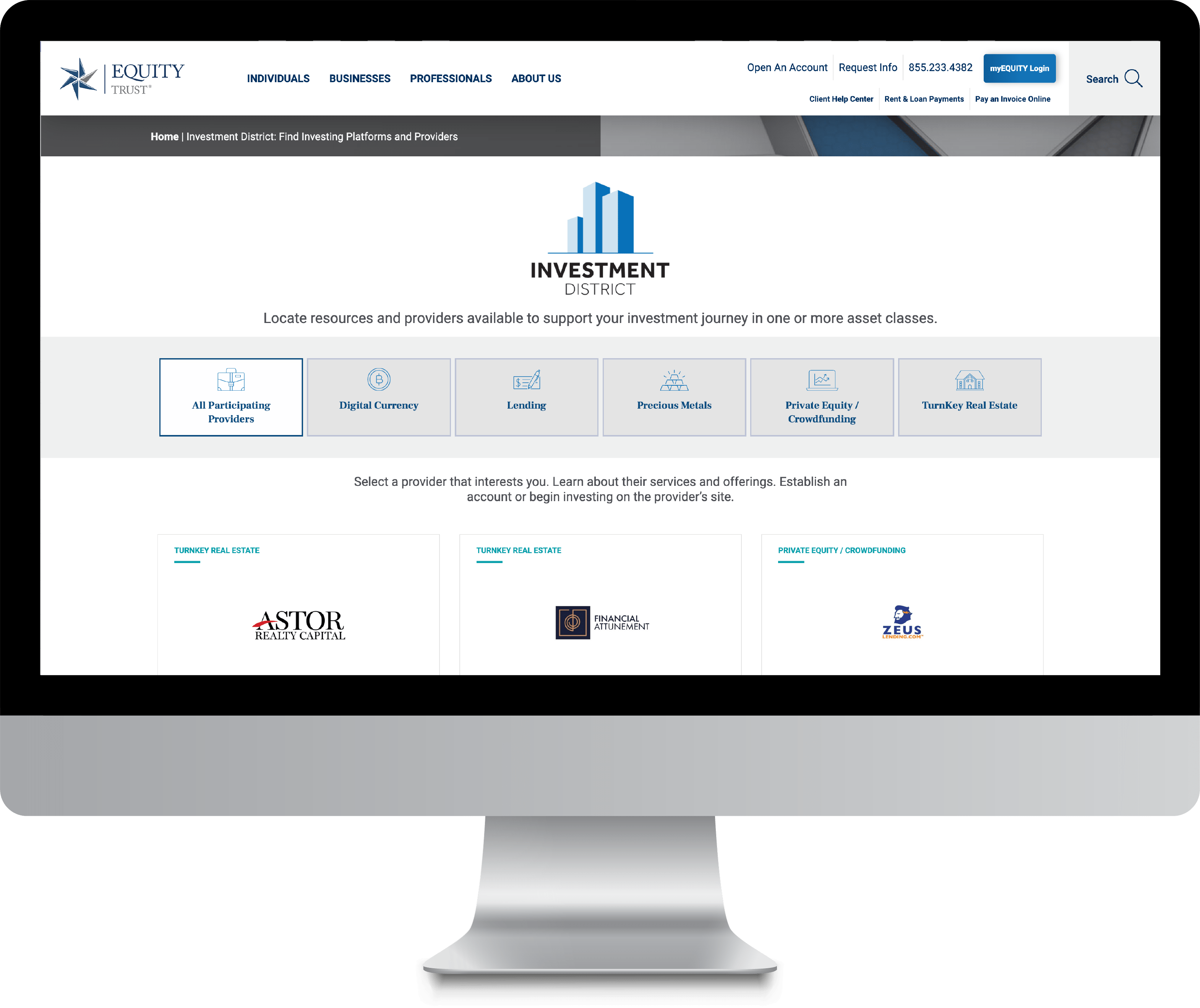

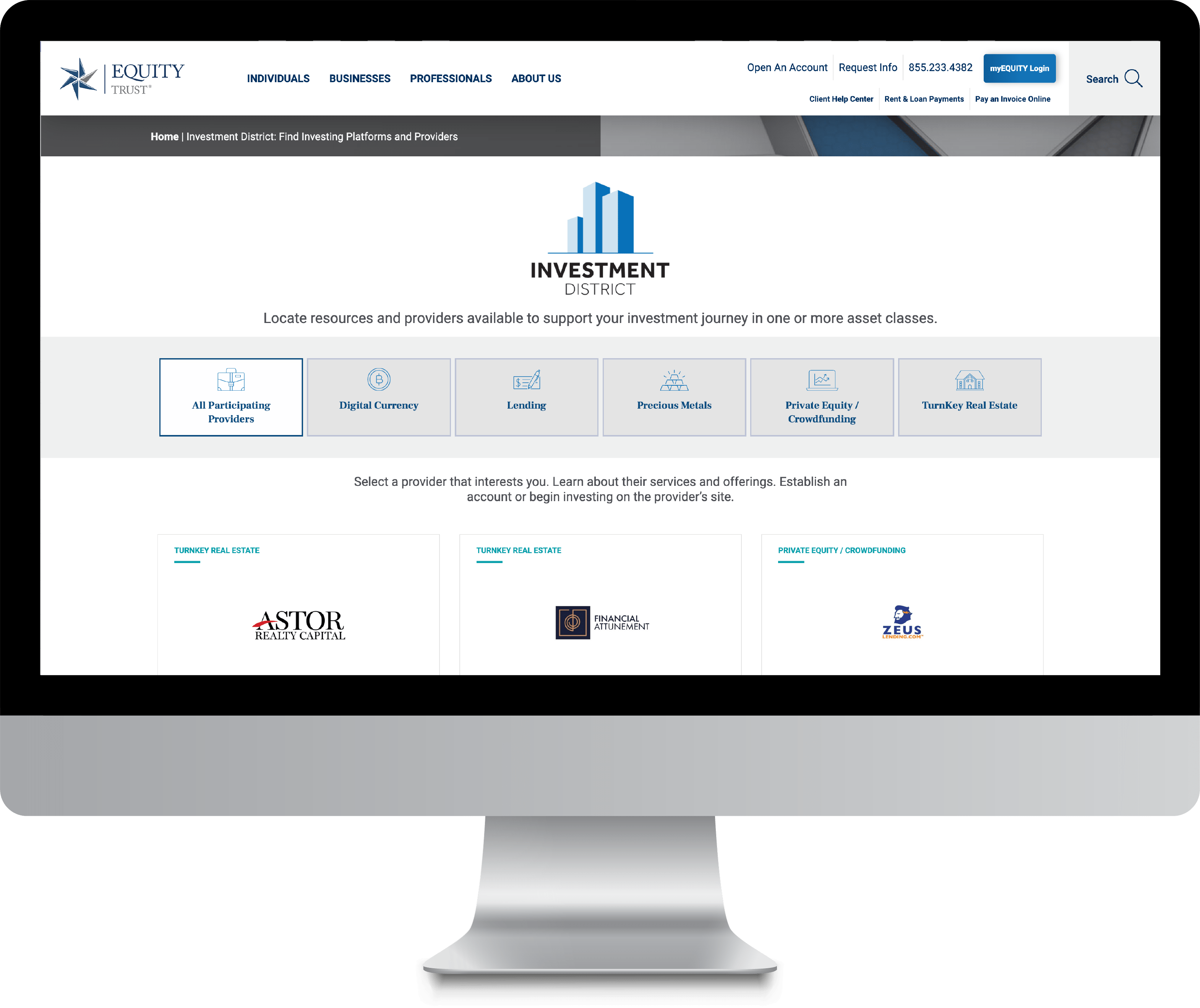

Expand Your Reach with Investment District

Talk to us about potentially extending your offering with Investment District, our online marketplace. MetalsConnect users who qualify can increase exposure among investors with funded accounts seeking their next opportunity.

- Investors can browse and choose from listed platforms and providers in the cryptocurrency, lending, precious metals, private equity/crowdfunding, and turnkey real estate asset classes

- Publish your company logo, description, and materials on the Investment District site and be immediately visible to one of the industry’s largest audiences

- Feature-rich: Intuitive and easy-to-find investment categories and search capabilities

- Actively visited by Equity Trusts clients via multiple channels including emails, portals, and website

- Easily access reporting metrics and more

Talk to Us About Elevating Your Precious Metals Business

See if our industry-leading technology and service could help you connect with more investors: Request a MetalsConnect demo today.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.