Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Private equity investing (also known as private entity investing) usually refers to providing capital to companies that are not publicly traded in exchange for a percentage of ownership or interest. Once only accessible to high-net-worth individuals or “accredited investors,” private equity opportunities are now available to the average investor.

These options may be found through equity crowdfunding platforms or angel investing opportunities, for example. Talk to an IRA Counselor about the broad range of private equity assets that can be held in an IRA or other retirement account, including:

Investing in private equity in your retirement account offers you the opportunity to buy into companies

that aren’t publicly traded for potentially significant profits, while securing your financial future.

Historically better returns than public markets

Ability to directly invest in businesses/industries that interest you or align with your values

Accessible to the average investor through a range of equity crowdfunding and other opportunities

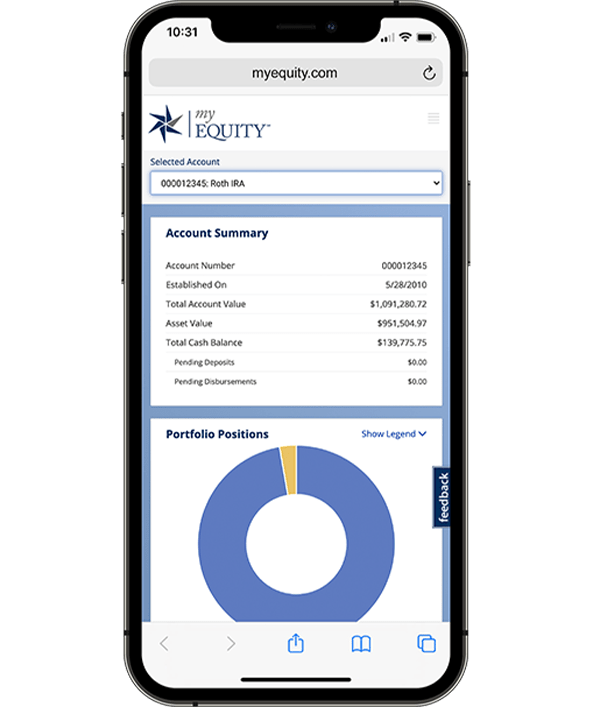

Easily invest in private equity, private entities, and countless other assets online with myEQUITY, our state-of-the-art online account management system. Our technology enables you to:

What are you investing for? Whether your “why” is retirement, healthcare expenses, or a loved one’s education, we make the journey easy with innovative technology and first-class service.

Let our industry-leading education and resources help you navigate through your investing journey.

Learn how it works, private equity investing rules, a real–life example, and how to get started.

Browse the tax–advantaged accounts and find one that matches your savings goals – from retirement to education to health care savings.

Dig deeper into how private equity investing works in a retirement account.

Ready to Get Started?

Our knowledgeable IRA Counselors can answer your questions about the self-directed investing process and share insight and education about our self-directed accounts to help you decide what options may be best for you.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue