403K

Total Accounts *

$66B

Assets Under Custody

and Administration **

50+

Years in the

Financial

Services

Industry *

Individual Investors We Serve

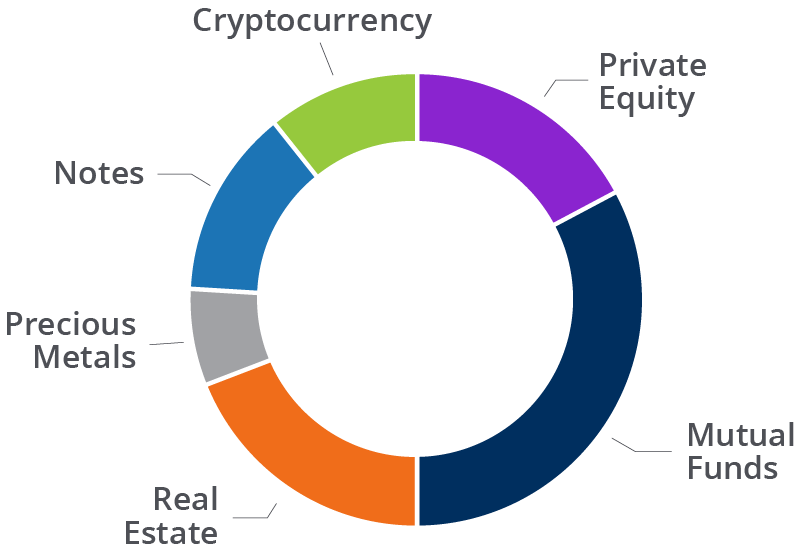

Whether you’re new to investing or a sophisticated investor, Equity Trust can help you achieve your retirement investing goals. We enable investors of all experience levels to invest their retirement accounts in a wide array of assets, from stocks and mutual funds to real estate and cryptocurrency.

We offer account custody and access to investments for:

- Investors looking to diversify into alternative assets

- Investors who want a mix of traditional and alternative investments in one IRA

- Non-accredited Investors

- Accredited Investors

Self-Directed IRAs

A self-directed individual retirement account (IRA) is like any other IRA you may be familiar with. The term “self-directed” refers to the fact that you’re in the driver’s seat. Rather than relying solely on fund managers or financial advisors, you can make your own investment decisions, conduct due diligence, and choose assets you believe will perform well. This level of control is appealing to those who want a hands-on approach to their retirement saving.

With a self-directed IRA, your investment options are expanded to include alternatives to the traditional stock and mutual fund investments many accounts are limited to. Instead of naming what you can invest in, the IRS only lists a handful of items that are not permitted in an IRA. Aside from that list, the sky’s the limit – provided you follow IRS guidelines for the account.

Expand Your Investing with the Universal IRA

The Universal IRA enables you to manage multiple asset types in your IRA without the hassle of managing multiple IRAs at different institutions. You can hold both traditional assets like stocks and mutual funds, as well as alternative assets such as real estate and private equity, all within a single IRA. This flexibility simplifies the investment process, allowing investors to easily diversify portfolios and manage investments with one custodian and an integrated platform.

Gain More Control Over Real Estate Investments with a Checkbook LLC

Take direct control of your real estate IRA investments with the Real Estate Checkbook IRA LLC. A Checkbook IRA enables you to write checks for your investment expenses directly from your LLC, speeding up the investment process so you can capitalize on time-sensitive real estate investment opportunities.

Why Investors Choose Equity Trust Company

Here are a few reasons Equity Trust is an industry leader in self-directed IRAs:

Nearly limitless investments, one IRA

Traditional financial institutions limit your IRA to traditional investments. With Equity Trust, you can truly diversify into a range of options such as real estate and private equity – in addition to stocks, bonds, and mutual funds.

The power to help you succeed

Our size, experience, and technology help us ensure that we’re there when you need us most. With 500+ associates focused on processing 2.5M+ transactions each year, we work diligently to enhance your experience and follow your direction.

Your direction, our support

Our knowledgeable, client-focused associates are here to provide dedicated, personalized service, from opening your account to assisting you with processing your investment transactions. You can lean on our 50+ years of experience in the financial services industry.

Access to opportunities to match your goals

Don’t have an investment in mind? Most other custodians establish your account and leave you on your own to figure it out. Our Investment District online marketplace enables you to find and research potential alternative investment opportunities with the click of a button, and our WealthBridge portal connects your account instantly to integrated investment providers for fast, easy research and potential investing.

Nearly limitless investments, one IRA

The power to help you succeed

Your direction, our support

Access to opportunities to match your goals