Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|20+ Real Estate Investment Strategies Working in an IRA (with Real-Life Examples)

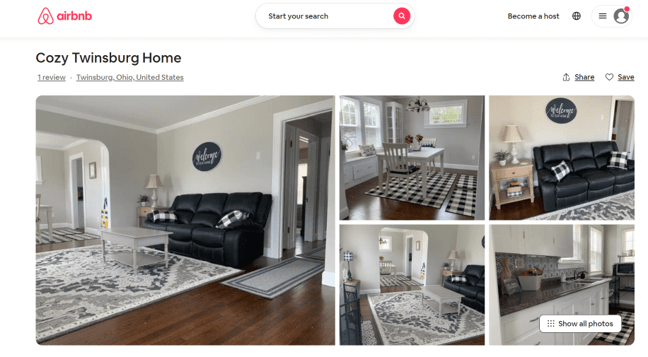

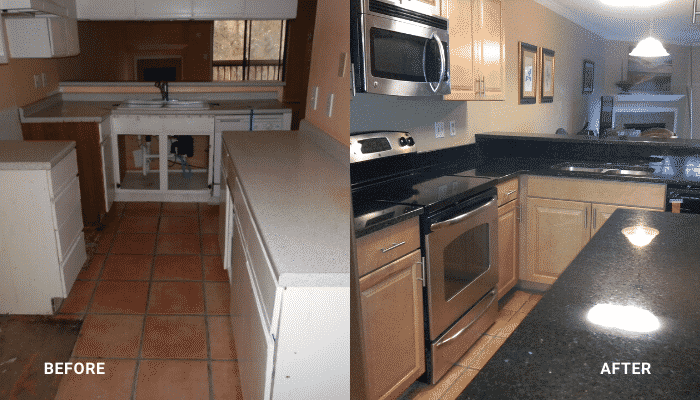

Real Life Examples

If you’re interested in real estate investing to diversify your portfolio but don’t know where to start, there are more options than you might realize.

Here are 23 real estate investing techniques, plus details on how real Equity Trust clients are using these approaches to grow their wealth. As diverse and wide-ranging as these examples are, they all have one thing in common: they all involved funding from a self-directed IRA or other account, enabling the investor to enjoy tax-deferred or tax-free profits.

Are you interested in utilizing these real estate investing strategies with your retirement funds?

All of these investors started with that first step into self-directed investing. If you’re ready to get started or get up to speed on self-directed real estate investing, talk to a knowledgeable IRA Counselor today.

What investment options are possible with an Equity Trust account?

Can my IRA purchase real estate that my corporation, partnership or LLC owns?

Case studies are provided for illustrative purposes only. Past performance is not indicative of future results. Investing involves risk including possible loss of principal. Information included in the above case study was provided by the investor and included with permission. Equity Trust Company does not independently verify all information provided by third parties.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue