Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|Get Started with a Traditional or Roth IRA in 3 Easy Steps

Managing Your Account

Whether opening an IRA for the first time or establishing an IRA at Equity Trust Company to increase your investment possibilities, follow this simple three-step process to get started.

You can open your Equity Trust account online in less than five minutes with the Account Open Wizard in the account management system myEQUITY.

What you’ll need:

After providing the required information, you will conduct a final review, approve with eSignature, and complete your new account application.

What’s next?

Equity Trust Company will process your application and establish your new IRA within 24 hours. You will then receive a welcome call to walk you through your new account and complete your method of funding (if applicable). You will also receive a robust welcome package in the mail to maximize your experience with Equity Trust Company.

There are three main ways to fund your Traditional or Roth IRA:

Out-of-pocket contribution

Assuming you qualify, you can make a contribution to your IRA from your personal checking or savings account, or with a credit card payment. This funding method is subject to maximum contribution limits set by the IRS each year. Equity Trust requires a minimum contribution of $500 to open a new self-directed IRA.

Transfer

If you have an existing Traditional IRA or Roth IRA at another financial institution, it’s possible to transfer your IRA to your newly established self-directed IRA at Equity Trust. During a transfer, funds and/or assets from your existing IRA at the current financial institution are moved directly to a compatible account at Equity Trust (Traditional IRA to Traditional IRA or Roth IRA to Roth IRA).

Unlike out-of-pocket contributions, there are no limits on the amount you can transfer.

Transfers can be initiated online with the myEQUITY Transfer Wizard. You have the option to complete a full or partial transfer and may also transfer existing assets, in addition to cash balances.

Once you initiate a Transfer request, we’ll work with your current custodian to complete the transfer. In some instances, you may be required to initiate all or part of your transfer with your current custodian.

Rollover

If you have a qualified plan from a previous employer, such as a 401(k), 403(b), 457, Thrift Savings Plan, or other qualified plan, you would conduct a rollover. A rollover involves moving funds from a qualified plan to an IRA and typically occurs when the account owner receives a personal distribution from their previous employer or current administrator of their plan and deposits it into the new account.

This process is started by requesting a rollover from your previous employer or current plan administrator, along with instructions to send the funds to Equity Trust. Your current plan administrator will provide the documentation needed to process your request.

After receiving the distribution, the account owner has 60 days to deposit, or “roll over,” the funds into a new account. It may be possible to request a direct rollover, where your plan administrator makes the payment directly to your new account. Contact your plan administrator for instructions.

As with transfers, it’s possible to do a full or partial rollover of cash and/or assets.

It’s also important to note that you are limited to one rollover within a one-year period. This limitation does not apply to direct transfers from one IRA trustee directly to another. Check irs.gov for more information.

These options are not mutually exclusive – it’s possible to fund your IRA by one, two, or a combination of all three methods.

Video: Moving Money from an Existing Retirement Plan to a Self-Directed IRA

Another option: conversion

Additionally, it may be possible to fund a Roth IRA through a Roth conversion.

This process involves converting funds and/or assets from a tax-deferred account (such as a Traditional IRA, SEP IRA, SIMPLE IRA, 401(k), or other tax-deferred plan) to a Roth IRA. Because you are converting from a tax-deferred account to an after-tax Roth IRA, the amount of the conversion is added to your ordinary income in the year of the conversion and subject to ordinary income tax.

Because it is a taxable event, it’s important to consult with a CPA, tax attorney, or other financial professional when considering a Roth conversion.

To facilitate a Roth conversion, both a Traditional IRA and a Roth IRA would be established at Equity Trust. The tax-deferred account(s) would then be transferred and/or rolled over from your current financial institution(s) to your newly established Traditional IRA at Equity Trust.

You can then initiate a transfer from your Traditional IRA at Equity Trust to your Roth IRA to complete the conversion. If completing a full conversion, your Traditional IRA would then be closed after the conversion is complete and your Roth IRA is funded and ready to invest.

Conversions are reported on IRS Form 8606, Nondeductible IRAs. See IRS Publication 590-A for more information.

Note: Even if you exceed the income limits to be eligible to contribute to a Roth IRA out of pocket, you still may be able to convert to a Roth IRA.

Watch: 3 Ways to Fund a Self-Directed IRA

Once your account is open and funded, you are ready to invest. At Equity Trust Company, you direct all investments for your account with the freedom and flexibility to diversify your portfolio with both alternative and traditional assets.

If you haven’t yet located an investment for your self-directed account, no problem. Equity Trust’s Investment District online marketplace connects you to investment providers in various in-demand asset classes, making it easy to find an opportunity that suits you.

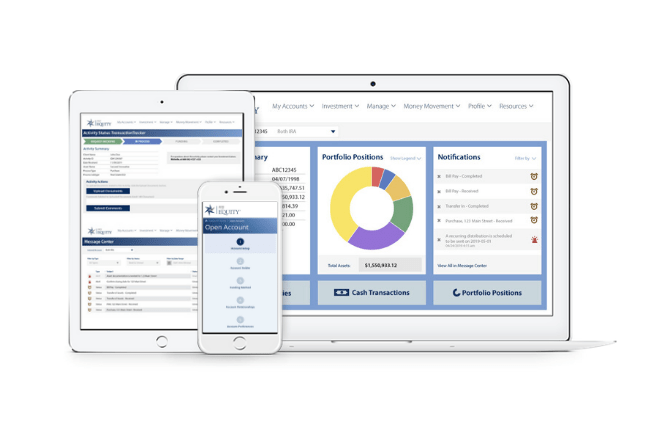

After you’ve identified your investment, myEQUITY makes it easy to invest online and delivers a clear line of sight before, during, and after each transaction with around-the-clock access from any device.

Simply log into myEQUITY, select the type of investment you wish to make, and let the online wizards walk you through a streamlined process.

Before you can begin to invest, it’s critical to open and fund your account. Call 855-673-4721 or open your account online to get started today!

How do I roll over funds to my self-directed IRA?

How long do rollovers take?

How long do transfers take?

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue