Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|Health Savings Account: FAQ

Tax-Advantaged Accounts

A Health Savings Account, with its potential triple tax benefits, can be a powerful way to save for healthcare-related expenses in retirement. Who can open an account, and what are the qualifications? Find the answers to your HSA questions below.

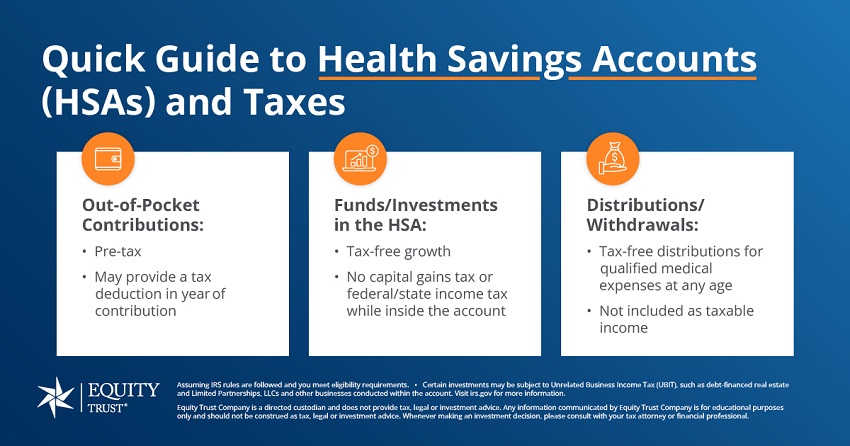

An HSA is like an IRA for health care expenses. It allows you to control costs by reducing health insurance premiums and putting money into an account to pay for current and future health care expenses. Contributions can be made to the account annually with pre-tax dollars, subject to limitations, much like contributions to IRAs. Contributions and earnings in the account can be withdrawn to pay for qualified medical expenses at any time without tax consequence.

HSAs have eligibility rules. To be eligible for an HSA, you must:

There are some qualifications. If you are covered by an HDHP, but have insurance policies that cover specific injuries or diseases, you are not disqualified. The same is true of Accidental Death and Disability coverage, long-term care coverage, dental care plans, and vision plans.

An HDHP has been defined by the IRS as a health plan with a minimum deductible of $1,600 for an individual plan and $3,200 for family coverage. An HDHP must also have out-of-pocket expenses, like deductibles and co-pays, which don’t exceed $8,050 for individual plans or $16,100 for family coverage in 2024. Out-of-pocket expenses can be higher for services that are provided outside the plan network.

If you have a self-only account, you may contribute up to $4,150 to an HSA in 2024. If you have a family plan, you may contribute up to $8,300 in 2024. A catch-up provision allows account holders age 55 to 65 to contribute an additional $1,000 per year.

Unlock Your HSA Guide to Discover:

Funds in a self-directed HSA can be invested in the same manner as other self-directed retirement accounts – meaning you’re not limited to stocks, bonds, and mutual funds. Returns on the investments are added to the account and accumulate tax-free.

Returns are not considered contributions and don’t count toward the contribution limits.

Funds can be withdrawn, tax-free, from an HSA at any time as long as they are used to pay qualified medical expenses. If used for any purpose other than qualified medical expenses, those funds are subject to a 10-percent penalty and are taxed at ordinary income tax rates for account holders under the age of 65.

If you are over the age of 65, funds withdrawn and used for purposes other than qualified medical expenses are taxed at ordinary income tax rates, but aren’t subject to the 10-percent penalty.

The IRS defines qualified medical expenses as medicine, doctor’s visits, diagnostic and treatment services, long-term care and some health care insurance premiums. See examples of covered expenses here. For additional information, please see IRS Publication 502.

It’s your sole responsibility as the account holder. It’s not the obligation of the account custodian.

Yes, the distributions are reported annually to the IRS by the account custodian using forms 1099-SA and 5498-SA. The custodian is not responsible for reporting how the funds were spent. That’s the obligation of the account holder. With that in mind, you should keep good records and retain all receipts and statements. You must file Form 8889 and file it with your Form 1040 if you (or your spouse, if married filing a joint return) had any activity in your HSA during the year. You must file the form even if only your employer or your spouse’s employer made contributions to the HSA.

Yes. If your spouse is the person inheriting the account, the account can remain classified as an HSA. If the inheriting person is not a spouse, the account will no longer be treated as an HSA and the fair market value of the account becomes taxable to the beneficiary in the year of your death.

As with an IRA, contributions into an HSA may be made until April 15 (or tax filing deadline) for the prior tax year.

As part of the CARES Act, the list of qualified medical expenses for using an HSA was expanded. Items added include feminine hygiene products and certain over-the-counter medications. The rules apply to items purchased after December 31, 2019.

An additional, temporary rule change affects High Deductible Health Plans (HDHPs). Under the CARES Act, telehealth services may be covered by an HDHP that has a deductible or below the minimum deductible otherwise required. The new rule applies to services provided on or after January 1, 2020.

Video: Self-Directed HSA FAQ

However, if your employer has a low deductible plan, you won’t be able to contribute to the HSA but can still invest current funds.

Yes, but only those contributions made by the individual. Employer contributions aren’t tax-deductible.

A self-directed HSA can be opened by completing an application. Click here to get started.

For more information on HSAs and how one can be established for you, start a conversation with a knowledgeable account counselor.

What types of accounts does Equity Trust offer?

What is the Annual Maintenance Fee for a CESA or an HSA account?

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue