Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|How Cryptocurrency Investing in a Self-Directed IRA Works

Cryptocurrency Investing

There are several potential advantages to investing in cryptocurrency an IRA, known as a self-directed IRA, including tax savings and the ability to diversify your portfolio.

With Equity Trust Company, you receive access to industry-leading cryptocurrency providers and an investing experience customized to your comfort level. You’ll receive the unbeatable combination of Equity Trust’s industry-leading cryptocurrency platform and account custody, plus the service and expertise only these providers can offer.

Once you’ve decided self-directed cryptocurrency investing is for you, how does the process work?

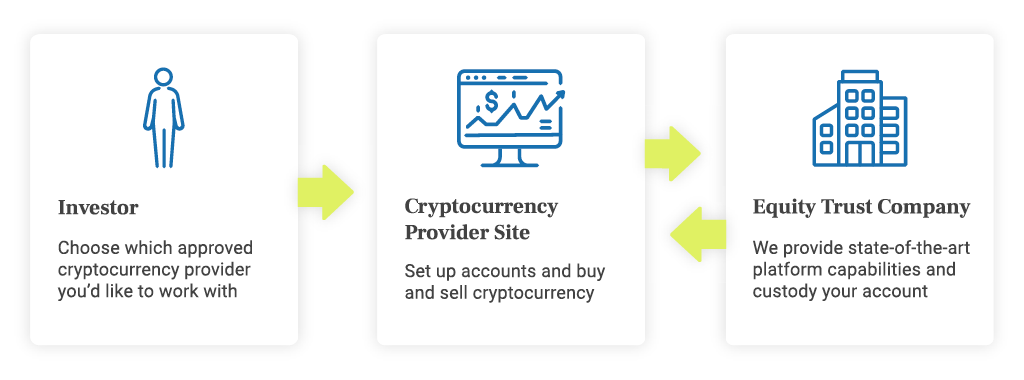

At Equity Trust, it’s possible to get started in three simple steps.

1. Visit our Cryptocurrency investment page to view the cryptocurrency provider options

Click here to visit the Cryptocurrency page.

2. Choose the approved cryptocurrency provider you’d like to work with

From our Cryptocurrency page, click on a provider logo to be taken to their site.

3. Begin purchasing Cryptocurrency in your IRA

From the provider site, set up your account and begin buying and selling cryptocurrency.

We provide state-of-the-art platform capabilities and custody your account.

Ready to get started? Click here to browse cryptocurrency providers or call us 888-382-4727 to get more information about cryptocurrency in an IRA.

Am I eligible to make a contribution? How much can I contribute?

Is there a limit to the number of rollovers I can do a year?

As Equity Trust Company (“Equity Trust”) is a directed custodian, like any investment, it is your responsibility to conduct your own due diligence before investing and before choosing a provider that is right for you. Equity Trust may, from time to time, establish independent contractor relationships with third-party providers, as provided above, whereby you, as the IRA owner, can have access to third-party providers for services that may be beneficial to you. Equity Trust is not an affiliate of any such provider. Equity Trust makes no recommendation or representations as to any provider and service or the needs generally of any IRA owner or any IRA. Any service available from any provider that offers investment education or advice solely reflects the views of such provider and in no way represents any recommendation or advice from Equity Trust. Opinions or ideas expressed by third parties, their affiliates, and employees are not necessarily those of Equity Trust nor do they reflect their views or endorsement. IRA owners are in no way obligated to purchase services and IRA owners are free to choose a provider with services as they deem appropriate. IRA owners should consult with their financial and legal advisors before choosing to work with any provider.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue