Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|Exploring Education Savings Strategies: Options to Avoid Student Debt

News and Trends

With the cost of 4-year colleges continuing to rise, parents and students alike are left to figure out how to afford an education without taking on significant debt. The U.S. has over $1.6 trillion in student loan debt with the average amount owed sitting at $28,950 per person, and more than half of students leave both public and private universities with debt.

From scholarships and grants to savings plans, families are searching for effective strategies to manage these rising costs and reduce the need for borrowing. Nowadays, it’s more important than ever for parents and students to explore all available options to minimize debt and secure a brighter financial future.

Preparing for the cost of college requires careful planning and a proactive approach. By exploring various savings options, seeking out scholarships, and understanding potential expenses, families can create a financial strategy that helps ease the burden of higher education costs.

Affordable alternatives to a four-year college degree

While many students aim for a traditional four-year degree, community colleges and associate degree programs provide quality education at a fraction of the cost, allowing students to gain valuable skills and credentials without accumulating significant debt. These alternatives also offer flexibility to transfer credits to a four-year institution later, making it an effective for those looking to minimize costs while pursuing higher education.

Evaluating future income potential

If student loans seem unavoidable, it may be wise to weigh the cost of the degree against its future earning potential. Evaluating whether the chosen degree or college is worth the investment can help in making an informed decision. Degrees in high-demand fields like STEM (science, technology, engineering, and math) often lead to higher starting salaries and faster income growth, making it easier to pay off loans more quickly.

Scholarships and financial aid

Scholarships and financial aid are traditional options for those attempting to minimize costs. Scholarships and aid extend beyond traditional academic or athletic awards from the university. Non-academic scholarships can be awarded based on community service or involvement, extracurriculars like the arts, or financial need. They can be found through school counselors, club and association websites, and websites exclusively for listing scholarship opportunities.

Saving strategies

Alongside traditional savings in a savings account, one underutilized option to potentially minimize the costs of attending college is an education savings account, or an ESA. An ESA is a trust or custodial account set up by a parent or adult for a child, which allows them to save funds ahead of time to spend on qualified educational expenses. These funds can be invested to help the money grow over the years.

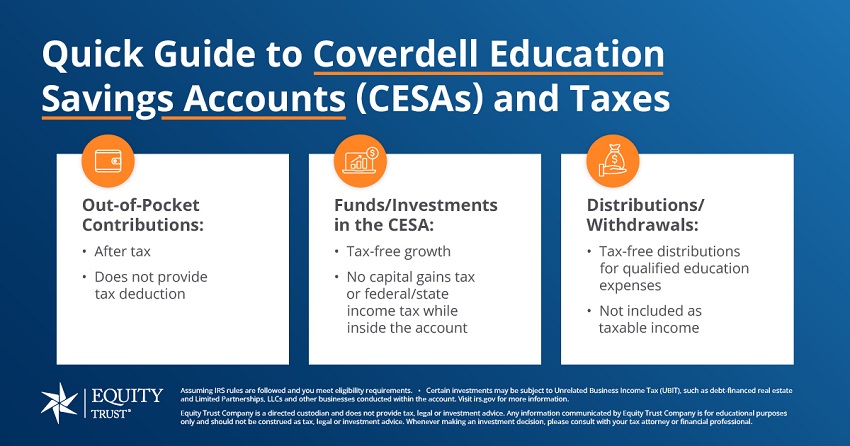

One type of ESA is a Coverdell ESA, or CESA. A CESA is an account specifically designed to pay for the qualified education expenses of a designated beneficiary. Funded with after-tax dollars, the account’s earnings grow tax-free, provided they are used for eligible costs like tuition, books, and supplies.

CESAs offer a flexible and tax-advantaged way to save for a child’s education, from elementary school through college, allowing for diverse investment options to help grow the savings over time.

Is a CESA the same as a 529 Plan?

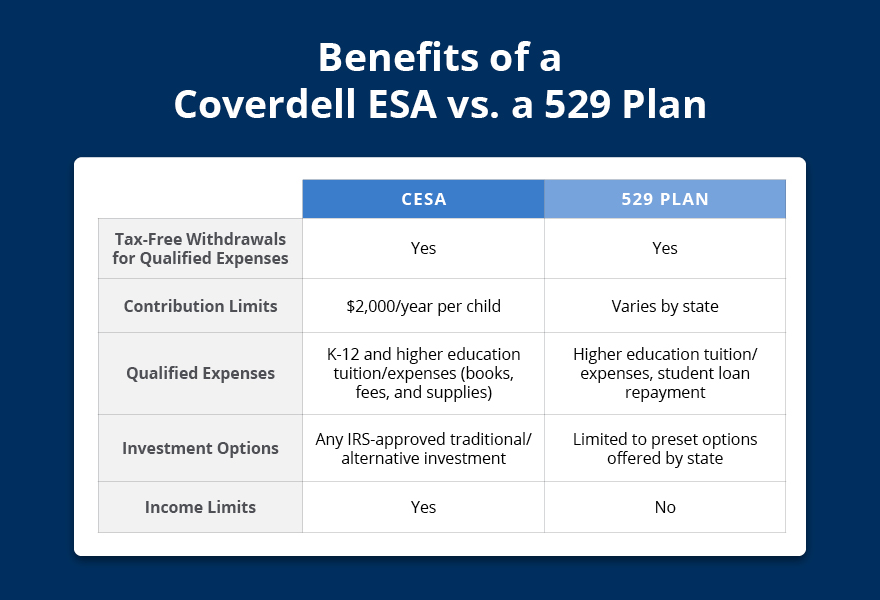

While both a Coverdell ESA and a 529 plan are investment accounts designated specifically for educational expenses, they are in fact two different accounts and have key differences in aspects like contribution limits, qualified expenses, and available investments. For example, CESAs allow more investment options, like with a self-directed CESA, in comparison to 529 plans which have more restrictions. Discover the differences between a CESA and 529 plan in our blog.

Can a Roth IRA be used for education?

A Roth IRA can also be used to help lower education costs. While Roth IRAs are primarily designed for retirement savings, if the funds are used for qualified higher education expenses, you can also withdraw earnings before age 59½ without incurring the 10% early withdrawal penalty. However, it’s important to note that while the penalty is waived, taxes may still apply to the earnings portion of the withdrawal.

Like all investment or savings accounts, CESAs have rules surrounding contribution or income limits and eligibility. The maximum contribution limit is $2,000 per year per child, and those who contribute don’t have to make earned income to be allowed. There are also certain requirements surrounding qualified expenses and penalties on withdrawals of funds that don’t meet the qualifications. To learn more, see our post on rules for a Coverdell Education Savings Account.

What can you pay for with a Coverdell ESA?

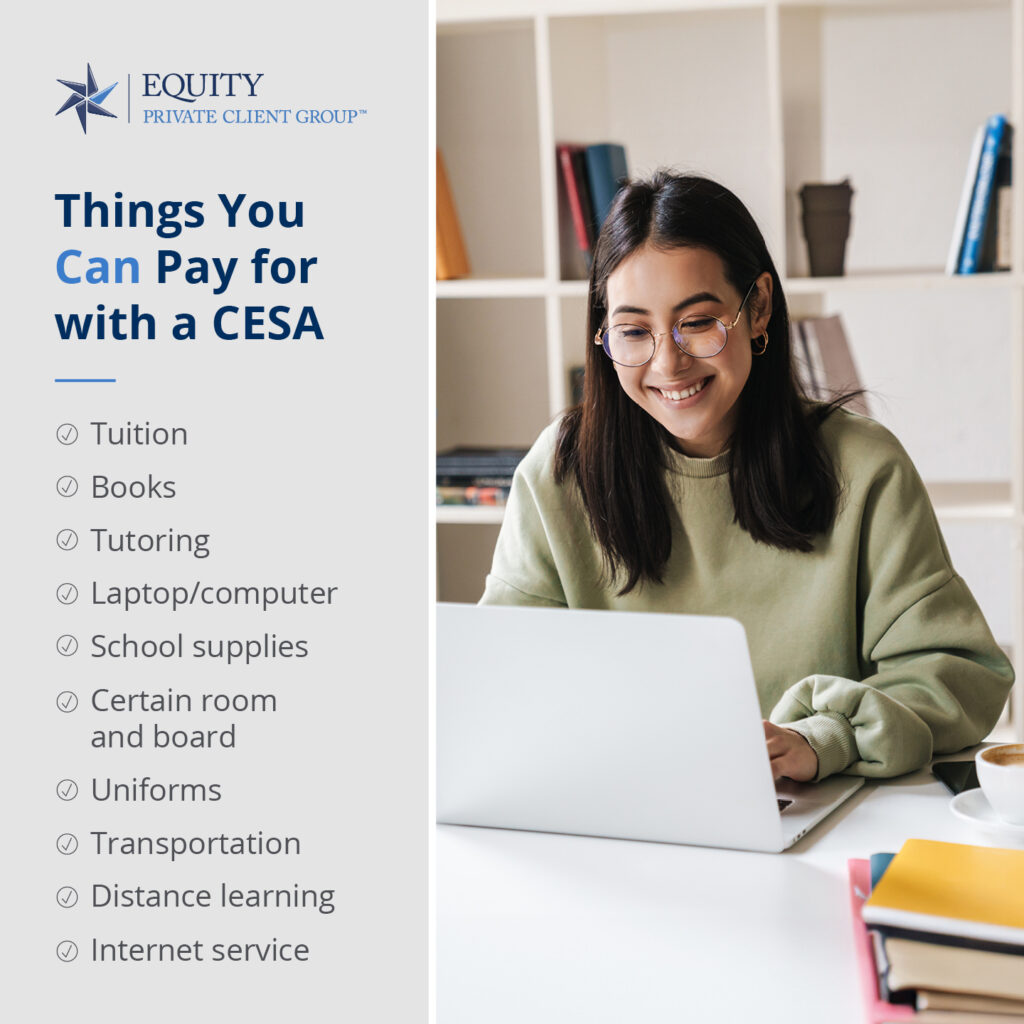

With a Coverdell ESA, you can pay for qualified expenses such as tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. This flexibility extends beyond just college expenses; funds can also be used for K-12 education, covering costs like tutoring, uniforms, and even technology required for remote learning.

For more information, you can check out our FAQs on Coverdell ESAs.

Although the contribution limit of a CESA seems low at $2,000 annually, you can still achieve growth in your account through strategic investments and consistent contributions.

When Brian from Tennessee discovered that he could self-direct his retirement and his children’s Coverdell ESAs into alternative investments like real estate, he was eager to get started. Concerned about the small balances in his children’s accounts, Brian learned that he could partner his family’s accounts to make investments.

He began by using three of his children’s CESAs to purchase a vacant lot in Nashville for $8,000, which he sold just 60 days later for $60,000.

Encouraged by this success, Brian then partnered five accounts—including his and his wife’s Roth IRAs and his children’s CESAs—to purchase two adjacent lots for $120,000. After re-marketing the property, he sold it for $200,000, resulting in a significant profit. Through strategic real estate investing, Brian successfully grew his family’s accounts, helping to secure both his retirement and his children’s educational futures.

Ready to harness the growth potential and diversification benefits of a Coverdell ESA for your child’s education? Discover how a self-directed CESA can help you invest in a wide range of assets, including alternative investments like real estate and precious metals. To learn more about CESAs, download the Coverdell Education Savings Account guide.

Start today and explore the innovative ways you can build a robust education savings strategy with a Coverdell ESA.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue