Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Notice: Be vigilant of potential scam callers impersonating Equity Trust employees. Learn More.

If you are a current Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Investor Insights Blog|David Interview Part I: Investor of the Year Helps Community Members in Need of a Home

Self-Directed IRA Concepts

John Bowens of Equity Trust interviews the winner of our Self-Directed Investor of the Year Contest, David from Kentucky.

Each year, Equity Trust clients submit a variety of different types of investments that they make in their retirement accounts, including real estate, tax liens, private lending, equity, and partnerships – some real estate-based, and some are non-real estate-based.

David is an active real estate investor who has retired from his job. He started in the real estate investing business many years ago and now owns properties in and outside of his self-directed IRA.

David provides details and education on his experiences, how he began to develop a rental property portfolio in his self-directed IRA, as well as how he manages his rental properties outside of his retirement plan.

John: Congratulations, David. Can you introduce yourself and maybe start off by just telling everybody a little bit about how you got involved in real estate investing many years ago?

David: Well, thank you for having me. And thank you for the generous award. We started in real estate a number of years ago, because my niece was being taken advantage of by a slumlord, who was charging her through the roof for a broken down trailer that had no heat and no roof in one of the bedrooms. And so we found a house, bought it for her and became her bank and helped her to get her life back on track.

A number of years later, she moved back out of the area. And we were left with his house. And we were trying to sell it in a time period that houses weren’t selling.

A lady from the church said, “I’ve got this girl that would like to rent it, would you consider?” We said yes, that worked out very nicely. And it just kind of blossomed from there.

John: That was well before you were investing with a self-directed IRA. So that’s what got you into real estate investing. What got you into using a self-directed IRA to invest in real estate?

I was able to make quite a bit more money on the rental properties as opposed to the stock market, plus I was able to get involved in people’s lives and be a mentor to them and be a light into their world.

David, Real Estate Investor, Kentucky

David: It was just an option that came available because of my 401(k). And these opportunities came along and I was able to make quite a bit more money on the rental properties as opposed to the stock market, plus I was able to get involved in people’s lives and be a mentor to them and be a light into their world.

John: What was your experience up until then? You had what type of retirement plan before you moved into a self-directed IRA?

David: I had an additional IRA through my employer, I’d been a sales representative for 40 years.

John: Okay, so you had a 401(k)? You left there, rolled it over to a self-directed traditional IRA. Now, David, for the audience, so they understand this movement of funds. When you rolled over funds from that 401(k) into the traditional IRA. Was there any type of tax consequences or penalties?

David: No.

John: No, no tax consequences or penalties. So the money got moved over. And then when you did that first deal, when you bought your first property with that self-directed IRA, could you walk folks through what that looked like? How did you get money from the account? How did you work with Equity Trust? How did you facilitate the closing?

David: All I had to do was with my attorney that did the closing, just have her put Equity Trust with my name and IRA on it. She worked with you; your experts were helpful and teaching her how to do it as well.

And then we purchased the home and I would tell my contractors, “I cannot pay you out of my own pocket. What I have to do is submit your bill and then they will send you a check.” Everybody seemed to be fine with that. It worked very nicely and the checks went out very quickly.

John: David rolled over his 401(k) into a traditional IRA. He then executed on a purchase. And as David had mentioned, he worked with an Equity Trust investment liaison to coordinate the entire purchase process. So the titling on the property was “Equity Trust Company, Custodian FBO (for the benefit of) David’s IRA.”

So it wasn’t in David’s LLC, it wasn’t in David’s personal property trust or land trust, it was in his Equity Trust IRA. And then from there, as David described, all of the fix-up and repairs were paid for from the self-directed IRA. And then of course, all rental income goes directly back into the self-directed IRA.

David, have you ever had to file any type of tax return, such as a Schedule II or any other type of tax form associated with your self-directed IRAs that are owned that own rental properties?

David: I don’t believe so. I take everything to a CPA and she handles it.

John: The rental homes that you own outside of your IRA, obviously there are tax returns associated with and tax documentation associated with those properties, because those are taxable income-based assets. And then the properties in the IRA are tax exempt. So there are no tax returns or other filings associated with those investments.

I’m glad you brought up that you take everything to a CPA. Here at Equity Trust Company, we always encourage folks to work with their CPA, their accountant, or other financial professional. We’re a custodian that provides education information and custody services. But what we don’t do is provide tax, legal, or financial advice.

David, let’s jump into the transaction you submitted to become the Self-Directed Investor of the Year: how you found the property, how you got it under contract, what you bought it for, and how you rehabbed it?

David: Well, I got a call from this young lady who was asking for a four-bedroom house. She told me that her house had burned to the ground and she and her four children were living in a hotel and was unable to find a four-bedroom home. I told her we didn’t have any four-bedrooms, we only had three-bedrooms.

A couple of days later, she called back and talked to my wife, and was told the same thing. And then her situation was put out on Facebook and seen by friend of our son in Chicago. He called us to see if we could do something about it.

I just asked the Lord, “Father is there something about this that you’re wanting me to be involved in?” And it seemed like it was.

I had my Equity Trust account set up. I called our Realtor we went and looked at this particular home and liked it real well. I called the young lady at the hotel and she came down with her a couple of her kids and looked through it. She was delighted.

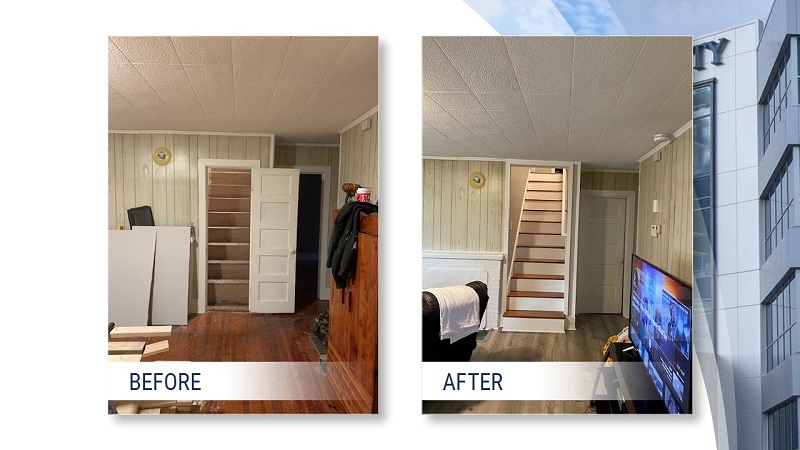

The next day we just placed an offer on it through our Equity Trust IRA and purchased it. To make it suitable for her, we did a little bit of remodeling. It was a little bit dysfunctional because to get from the living room to the kitchen, you had to cross a bedroom diagonally from one corner to the next.

So we took that bedroom out and made a straight hallway into the kitchen, and then used the rest of that bedroom and put a second first-floor, full bathroom on.

And then the upstairs had stairways that were dysfunctional and completely unsafe. We tore those out and made them safe again with the proper headroom. We put in a separate HVAC system up there and made two nice bedrooms up there.

John: You converted what was a three-bedroom into a four-bedroom house, added two bathrooms, and then obviously the HVAC system upstairs. It was a $96,000 purchase, and your IRA covered $47,000 in rehab.

And you have how much in gross rent coming in on a monthly basis?

David: $1,500

Video: Watch the entire interview with David

John: Your approximate return on investment, cash on cash return on investment on this transaction is 12.5 percent.

I think it’s important for everybody to understand that when we’re talking about the cash on cash return on investment, David bought this property free and clear all in cash with his IRA funds. So his IRA bought it for cash, he paid for all the repairs all in cash from the IRA.

It’s important to understand that when your IRA buys a property, your IRA has to finance 100 percent of the repair costs. So taxes, insurance, utilities, all rehab, all these expenses, correct me if I’m wrong, David, were paid for from your Equity Trust self-directed IRA.

[Related: Real Estate IRA Rules]

David: Yes.

John: Why didn’t you go to a bank or private lender or hard money lender to do this deal? Why did you do the deal 100-percent outright in cash with the IRA funds?

David: Because this deal will make a great deal more income for my retirement than what I would get through the stock market. Plus, the value of the house is now much greater than it was and is continuing to appreciate.

John: Do you use a property manager to manage the property day-to-day, or are you overseeing that yourself? As the IRA account holder?

David: I oversee it myself.

John: As far as the expenses are concerned, as you pay those expenses, can you walk through what that process looks like and how you access cash from the Equity Trust IRA to facilitate the expense payments? And then of course, how you get money back into the IRA?

David: When the contractor submitted a bill for something he had done, I would just enter that amount into the website (myEQUITY) for my Equity Trust account. And then Equity Trust would send a check directly to him within three or four days. And I have the lady’s rent going directly from the Kentucky Housing Corporation to Equity Trust. That’s done the first day of every month automatically.

John: What David’s describing there is using the online portal myEQUITY. This is an online technology system that enables David to simply log in and request where the funds need to be sent and if they need to be sent by check, ACH direct deposit, or wire transfer. And then Equity Trust sends the funds out.

In this case, David is sending a check, and that’s getting mailed out. But it is important for folks to know that we also have the functionality to send funds out via ACH direct deposit or wire transfer.

Great investment opportunity. It’s making obviously a significant return on investment.

But I do want to emphasize for everybody that this particular transaction didn’t start with “I found a good deal…I want to execute on doing it with my IRA to grow my IRA.” It actually started with a need of a local community member. Is that correct?

David: That’s correct. This young girl had given me a call and she needed a place to live. And we were able to purchase this home for her to rent.

John: The byproduct of that goodwill, of course, is this over 12-percent cash-on-cash return on investment in the self-directed IRA. And as David pointed out, he’s making a better return investing in this rental property, then he was investing in traditional stocks, bonds, and mutual funds.

Read Part II: Complete House Renovation Improves a Kentucky Neighborhood

I plan to purchase a rental property with my IRA. Does the rental income have to go back into my IRA?

Can my IRA purchase real estate that I currently own?

Case studies are provided for illustrative purposes only. Past performance is not indicative of future results. Investing involves risk including possible loss of principal. Information included in the above case study was provided by the investor and included with permission. Equity Trust Company does not independently verify all information provided by third parties.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue