Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

Investor Insights Blog|Saving for Your Child’s Education: Comparing Coverdell ESAs and 529 Plans

Self-Directed IRA Concepts

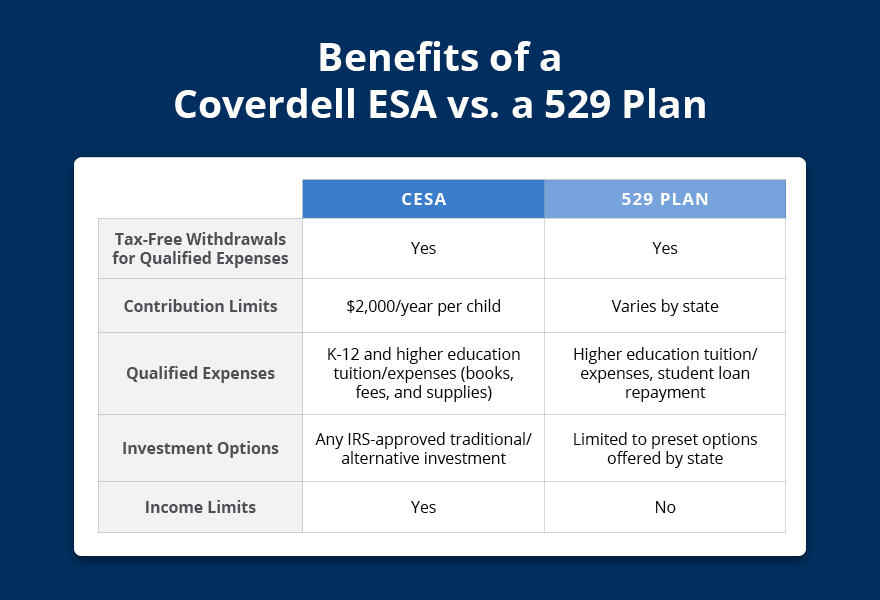

With the skyrocketing costs of college tuition, saving early for your child’s education is more important than ever. Two popular education savings vehicles are Coverdell Education Savings Accounts (also known as Coverdell ESAs or CESAs) and 529 plans. While both allow you to invest money for education tax-free, there are some key differences between the two.

Here’s an overview of how Coverdell ESAs and 529 plans compare.

A Coverdell ESA is an investment account that allows you to save up to $2,000 per year for a child’s K-12 and college education expenses. Contributions grow tax-deferred, and withdrawals are tax-free if used for qualified education expenses. Some key features of CESAs include:

529 plans are specifically intended for college savings. They allow you to invest after-tax contributions that grow tax-free. Some key features of 529 plans include:

As mentioned above, if a CESA is opened through a directed account custodian, it can be used to invest in a range of options in addition to stocks and mutual funds. Investments for a self-directed CESA can include real estate, land, private equity, private lending, and much more, similar to self-directed IRAs and other accounts.

Wondering how to use a Coverdell ESA with a small balance to invest in alternatives such as land or real estate? Read how Equity Trust client Brian partnered his children’s education savings accounts for two land purchases, which grew their balances quickly.

[Case Study] 2 Investments Earn $130,000 in Profits to Help Boost 5 Self-Directed Accounts

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue