What is a Checkbook IRA?

A real estate checkbook IRA, also known as a checkbook control IRA, checkbook LLC, or self-directed IRA with checkbook control, is a type of self-directed Individual Retirement Account (IRA) that gives you more direct control over investment decisions. This account structure also brings speed and flexibility to your investing, enabling you to write checks directly from the IRA to purchase allowable assets without the need to request for the custodian to process each transaction.

Checkbook IRA LLCs provide immediate access to IRA funds, which can be critical for real estate investments where timely payments are often necessary.

Videos

Benefits of a Real Estate Checkbook IRA LLC

Some real estate investors find advantages to having a self-directed IRA with checkbook control for their real estate investing. Here are a few main reasons:

Limited liability protection

An LLC can shield your personal assets from liability in the event of legal issues with a property.

Transaction speed

With control of your funds, you can move quickly on transactions, initiating wire transfers for real estate purchases, online real estate auctions, and earnest money deposits, to name a few.

Bank account connectivity

You can link your LLC’s bank account to online property management software, making it easy to pay for utilities and other expenses and collect rental income.

How Does a Checkbook IRA Work?

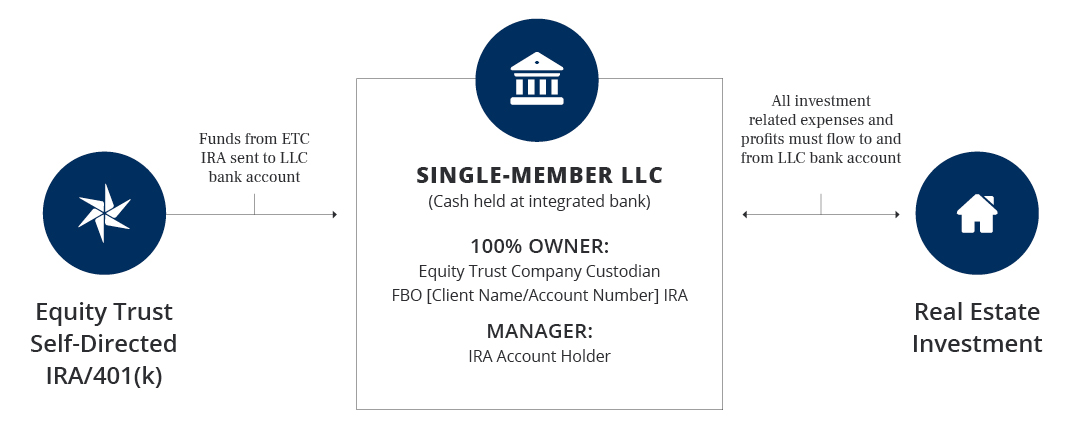

A real estate checkbook IRA is established when you form an LLC, direct IRA funds to be invested into the LLC, and use the LLC to purchase properties. A Real Estate Checkbook IRA LLC is not an account type, but rather a structure. As the IRA owner, you can be designated as the manager of the LLC, allowing you to set up a bank account in the name of the LLC to manage investments and cash transactions. LLCs can be formed as single-member (with your IRA as the owner and only member) or multi-member (with multiple investors/IRAs as members/owners). Funds are moved from the members’ IRAs or other accounts and deposited into the LLC’s bank account.

With checkbook control of the LLC, you can use funds from the LLC’s bank account to purchase investment properties or pay for investment-related expenses. Payment options include checks, wire transfers, ACH, and bank debit card.

How a Single-Member Real Estate LLC is Structured

How a Multi-Member Real Estate LLC is Structured (Example Scenario)

Percentage of ownership is proportionate to the capital contributed. Rules apply, including disqualified persons and prohibited transactions: See IRC 4975 for more information.

Checkbook IRA Rules and Considerations

When operating a real estate checkbook IRA, it’s important to follow the rules related to IRAs. Otherwise, you risk incurring penalties and losing the tax-advantaged status of the account.

Disqualified Persons: As the IRA owner, you’re considered a disqualified person to your account and may not receive salary or compensation from the LLC. Likewise, your account may not transact with other disqualified persons, including family members of lineal descent and any fiduciaries. Learn more about disqualified persons.

Prohibited Transactions: The IRS defines prohibited transactions as investments with disqualified individuals, “self-dealing” (using your IRA to pay yourself), and receiving indirect benefits. Learn more about prohibited transactions.

Handling of Funds: All income and distributions from the LLC must flow through the IRA.

Individual Responsibility: The account owner is responsible for all investing decisions.

Personal Oversight: All accounting for the LLC must be performed by the manager (you).

Professional Advice: It is critical to seek the advice of an accountant or tax professional to ensure proper facilitation of these complex accounts.

Opening Your Checkbook IRA

Opening a Real Estate Checkbook IRA LLC at Equity Trust is a straightforward process. Our team of dedicated onboarding specialists handles the administrative work to ensure a seamless experience along the way. Here’s what you can expect:

5 Easy Steps to Create Your Real Estate Checkbook IRA LLC at Equity Trust

Open and fund an Equity Trust self-directed retirement account

Open your chosen account type and fund it with a rollover, transfer, or contribution.

Form a new LLC

Our in-house service Equity Doc Prep can set up your new LLC, which should only be used to own and manage real estate investments.

Open a business checking account

The account, which is established with a specialized, integrated bank, is in the name of the new LLC.

Transfer funds to your checking account

Direct Equity Trust to transfer your funds to your business checking account.

Invest and manage your real estate investments

Revenue (rents) and expenses from your IRA-owned property must flow directly through your business checking account.

Pros and Cons of Checkbook LLCs

Before you open a real estate checkbook LLC, make sure you understand the potential benefits as well as the limitations of the account.

Pros

| Ability to write checks and make deposits for your IRA investments |

| Quick acquisition of real estate assets |

| Possible reduction of IRA administrative costs such as wire fees or expedited processing |

Cons

| Careful attention is needed to stay compliant with IRS rules |

| IRA owner (you) responsible for the recordkeeping of all transactions within the LLC |

| LLC establishment fee may not be cost-effective for some real estate investors |

Understanding Checkbook IRA Fees

A real estate checkbook IRA at Equity Trust requires the establishment of a single- or multi-member LLC. As with setting up any legal structure, there is a fee to cover the administrative cost.

Most IRA providers charge separate fees to establish an LLC, as well as additional fees for account maintenance and transactions. If you choose to set up your LLC with Equity Doc Prep, Equity Trust’s affiliate, your LLC establishment, account maintenance, and much more are included in one simple fee.

Equity Trust’s Real Estate Checkbook IRA LLC: The Complete Package for Real Estate Investors

For a one-time, flat fee you receive:

- Account establishment and funding

- LLC formation

- LLC state filing

- Specially Crafted Operating Agreement, unique to a self-directed IRA/retirement account

- EIN creation

- BOI filing to comply with Corporate Transparency Act

- Full banking connectivity

- Hassle-free LLC checking account creation

- Dedicated onboarding specialist

- Free access to our premier education program, the Self-Directed IRA Master Course ($997 value)

Your price:

- Single-Member LLC Package: $1,295

- Multi-Member LLC Package: $1,600

The Equity Trust Company Advantage

In addition to the comprehensive real estate checkbook IRA package, there are several advantages to choosing Equity Trust Company as your self-directed account custodian.

Nearly limitless investments, one account

Traditional financial institutions limit your IRA to traditional investments. With Equity Trust, you can truly diversify into a range of options including real estate, private entities, cryptocurrency, precious metals, and more, in addition to stocks, bonds, and mutual funds — all in one account.

The power to help you succeed

Our size, expertise, and technology help us ensure that we’re there when you need us most. With 500+ associates focused on processing 2.5M+ transactions each year, we work diligently to enhance your experience.

Your direction, our support

Our knowledgeable, client-focused associates are here to provide dedicated, personalized service, from opening your account to assisting you with investment transactions. You can lean on our 50+ years of experience in the financial services industry.

Talk to a knowledgeable IRA Counselor.

Access to opportunities to match your goals

Don’t have an investment in mind? Most custodians establish your account and leave you on your own to figure it out. Our Investment District online marketplace enables you to find potential investment opportunities with the click of a button, and our WealthBridge portal connects your account instantly to integrated investment providers for fast, easy investing.

Frequently Asked Questions

Are checkbook IRAs legal?

Yes, checkbook IRAs are legal, but they must be set up and managed correctly to comply with IRS regulations. A checkbook IRA typically involves establishing a self-directed IRA that invests in a Limited Liability Company (LLC) created specifically for the IRA’s investments.

What is the difference between a self-directed IRA and a checkbook IRA?

Both a self-directed IRA and a checkbook IRA enable you to invest in private market investments such as real estate. If that self-directed IRA is also a checkbook IRA, that means you can write checks to pay for investments and expenses related to the investment inside the IRA.

Can a self-directed IRA own an LLC?

Yes, in the case of a checkbook IRA, the IRA owns the LLC. This is why it’s important to follow all IRS rules related to prohibited transactions and disqualified persons when investing with a checkbook IRA LLC.

If I own or partially own a property, can my IRA-owned LLC purchase the property?

No, this would be a sale between the IRA and a disqualified person, and therefore a prohibited transaction.

Can I (as the account holder) manage the LLC?

The IRS does not explicitly forbid the account holder from being the LLC’s manager, though the account holder must not be compensated for their oversight of the LLC.

Can I invest into an LLC I already have set up?

No. It would be a prohibited transaction to invest your IRA into an entity that you, a disqualified person, own.

Do I establish the LLC or the IRA first?

Since the IRA’s titling and EIN will be used when listing the membership, you would open the IRA before setting up the LLC. Equity Trust Company can help with the entire process, ensuring the steps are completed in order.

How do I add money via contribution or rollover to the LLC, and how do I take distributions?

It is extremely important to understand the functionality and purpose of both the LLC and IRA. For all IRA-related line items such as a contribution, rollover, or distribution, those must all occur through the account at Equity Trust. When adding money to the LLC, the account owner makes their deposit to the IRA with Equity Trust, then directs our office to send funds to the operating account. All distributions or transfers to another IRA would require the LLC manager to return funds to the Equity Trust account first.

Can Equity Trust assist me with establishing an LLC?

Yes, by using Equity Trust, you can work with our in-house service professionals at Equity Doc Prep in the establishment of your single-member LLC, ensuring that your LLC is set up correctly to comply with IRS and custodial guidelines. Contact an IRA Counselor for more details.

Does this LLC need to file a partnership return (K1)?

No. When an IRA is a single member of the LLC, it is considered a disregarded entity for tax purposes as referenced in IRS Publication 3402.

Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional.

Equity Doc Prep, LLC (formerly Midland Forms, LLC) is a document preparation company and is not authorized to advise you as to which documents you should use or may need; such advice would be considered the “practice of law.” Please consult your legal or financial advisor before making any financial decisions. Under the guidelines for legal document preparation services, you must make all legal decisions yourself — including decisions about the type of documents you need.