Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

In observance of Good Friday, our offices will be closed on Friday, April 18, 2025. We will resume regular business hours on Monday, April 21.

Clients can visit myEQUITY at any time to see status updates, submit new requests, and receive up-to-date information regarding accounts.

Investor Insights Blog|Is it Possible to Have a Traditional IRA and a Roth IRA?

Tax-Advantaged Accounts

It’s a common decision investors face when selecting which retirement account to open: should I choose a Traditional or a Roth IRA? While this is a personal decision that depends on your unique situation and should be made by consulting with your financial advisor or tax professional, it doesn’t necessarily have to be an “either-or” decision. It may be possible to have both.

The primary difference between the two account types is the timing of taxation. This difference is whether taxes are paid on the IRA contributions or if they are paid at the time of distribution.

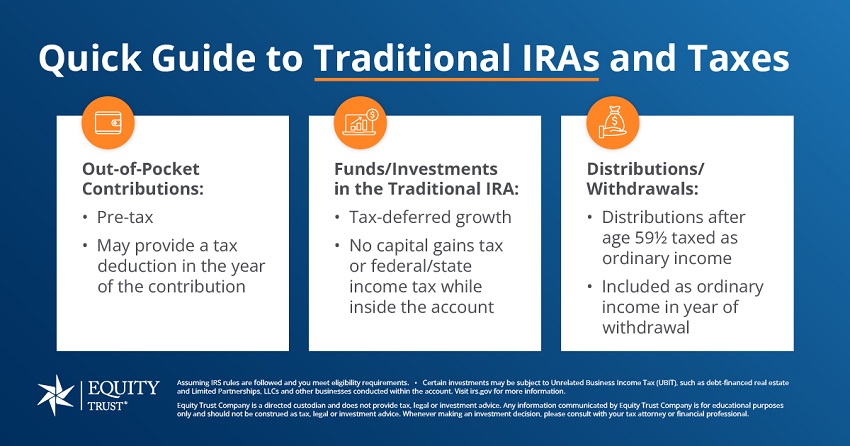

Contributions to a Traditional IRA are generally made with pre-tax dollars, which can lower your taxable income in the year of contribution. Investments within the Traditional IRA grow tax-deferred, meaning you won’t pay taxes until you begin withdrawing funds in retirement. At that point, distributions are taxed as ordinary income, potentially at a lower rate if you’re in a lower tax bracket in retirement.

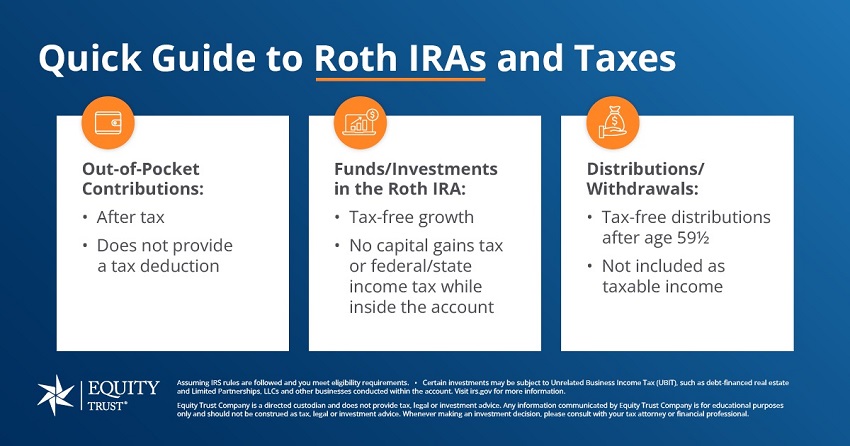

Roth IRA contributions are made with after-tax dollars, which means there is no upfront tax deduction. However, once funds are in the Roth IRA, they grow tax-free, and qualified distributions—those taken after age 59½ and after the account has been open for at least five years—are also tax-free. Roth IRAs also offer the added benefit of no required minimum distributions (RMDs) in retirement, providing flexibility in how and when you withdraw funds.

Yes, you can have both a Traditional IRA and a Roth IRA. As mentioned, the Traditional IRA and Roth IRA provide different tax advantages. If you and your financial professional decide both accounts are right for you, the flexibility could potentially be beneficial now and in retirement.

In the sections below, we’ll explore the potential benefits of having both types of IRAs, as well as some considerations and possible drawbacks to keep in mind.

Holding both a Traditional and Roth IRA can provide flexibility and tax advantages. Here are some key benefits:

Tax-deferred and after-tax contributions

Having both accounts allows investors to choose between tax-deferred contributions – Traditional IRA and after-tax contributions – Roth IRA – based on their current financial situation. This flexibility can be especially useful as income levels fluctuate over time, providing options for managing taxable income each year.

Portfolio diversification and flexibility

Which account is best for growth or value stocks? Should income-producing assets be held in a Traditional or Roth? What about REITs, rental properties, notes or other alternative investments?

These are questions for your advisor or financial professional but having both a Traditional and a Roth IRA arms you and your advisor with options. This dual-IRA strategy allows for more nuanced portfolio management and diversification, potentially enhancing overall retirement savings.

Tax flexibility in retirement withdrawals

Once you reach retirement age, having both accounts provides options for tax planning. Withdrawals from Traditional IRAs are taxed as income, while Roth IRA withdrawals are tax-free, allowing retirees to adjust their income sources to manage their tax bracket. Furthermore, Traditional IRAs require RMDs, but Roth IRAs do not, offering additional flexibility if funds in the Roth IRA are not immediately needed.

Video: Traditional IRA vs. Roth IRA

While there are benefits to holding both a Traditional and a Roth IRA, there are also a few considerations to keep in mind:

Contribution limits

The IRS enforces a combined contribution limit across all IRAs. For 2024 and 2025, that limit is $7,000 (or $8,000 if age 50+). That’s the limit on what can be contributed between a Traditional and a Roth IRA each year, which means individuals need to manage contributions carefully between accounts to avoid excess contributions and potential IRS penalties.

Complexity in retirement planning

Managing multiple IRAs can add a layer of complexity to retirement planning, requiring careful tracking of contributions and withdrawals. Having both accounts may require additional oversight, especially as tax strategies become more complex.

Tax implications for withdrawals

Since Traditional IRA withdrawals are taxable, it’s important to strategize around them in retirement to avoid unexpectedly high taxes. In some cases, working with a financial professional can help align withdrawals from both accounts with income needs and tax goals.

As you’ve read, it’s possible to have both a Traditional IRA and a Roth IRA and there could be potential benefits to having both. Since everyone’s situation is different, it’s important to consult with your financial advisor, CPA, or tax professional before making any financial decisions.

Download the Traditional & Roth IRA Comparison infographic for a handy resource detailing features of each account.

How do I roll over funds to my self-directed IRA?

When I roll over funds from an employer-sponsored or qualified retirement plan, do they need to go directly into a traditional IRA?

If I’m older than 72, can I transfer IRA assets from my current custodian?

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue