1. Mission

A clear mission for each property is critical. Think of the mission as a destination. If you were to take a road trip without knowing where you want to go first, it would be very difficult to get there. Setting the mission for your project first gives everyone a big-picture destination to shoot for and gives you the best shot at successfully getting there. An example of a mission might be: “We want to have a safer property for our residents.”

2. Vision

Now that there is a set destination, the path can be determined – this is the vision. Again, much like on a road trip, there are multiple routes. Which is the best for the asset? The mission guides selecting the most applicable path while ensuring timing, efficiency, and quality standards are maintained. An example of the path would be: “To increase safety on the property, we are going to add lighting around the property, install new security cameras, install security systems in units, and add security patrols.”

3. Plan

Once these previous two things are agreed upon, it is time to curate a plan for the asset. Each of these practices builds on one another and doing them in order sets the property up for the best success and potential for maximum growth. This is where we get granular and establish a detailed and accountable action plan. Using our example about increasing security, here we would start to detail a plan. How many lights are placed in what locations, at what cost, and by when will they be installed? I think you see the pattern we are trying to create here.

Every plan should include at least the following:

- Liability and risk analysis

- Financial summary

- Performance goal setting

- Leasing and marketing review

- Market rent analysis and market surveys

- Retention and turnover review

- Other income analysis

- Renovation and capital plan

- Exit Strategy

4. Accountability

This practice comes in after the takeover and once everyday management begins. At the end of the day, numbers and data don’t lie. To ensure the plan stays on target and everyone involved is doing the necessary actions, Key Performance Indicators (KPIs) are used for accountability. There are dozens of KPIs that need to be measured and monitored to ensure success and to demonstrate the need for adapting a plan as time goes on. However, there are a few to keep top of mind at all times.

These are our top five KPIs we track to gain a general view:

- Vacancy/occupancy

- Delinquencies/collections

- Renovation timing

- AP aged invoices

- Economic occupancy

These, and more, are tracked weekly, monthly, quarterly, and annually to get an accurate and clear representation of the plan, strategy, and execution of the investment.

5. Communication

Last, but most certainly not least, is communication. Clear communication happens throughout the process and across all roles in any successful project. When this happens varies depending on the company/partner and property but, as a passive investor, it is imperative that you are receiving regular communications on what is happening with the asset. This is to look at and ensure success in things like financials, property performance and progress, and any renovation/Capex updates (if applicable). If as an investor this is not a part of your experience it could be an indicator of the performance of your investment.

[Potential opportunities: Investment District]

How to look for these best practices

Now that you have all the “why,” it is time for the “how.” The fastest, easiest way to look for these practices is to ask questions like:

- Will there be someone dedicated to asset managing this property? If so, what other roles does that person currently hold?

- What reports will I as an investor be receiving throughout the hold period and when?

- Will there be a renovation plan in place with the property management team?

Another way to do this, if you don’t have a relationship with the operator, is to look at the information you were given when investing or what you receive when you go to invest. This could include an investment pitch deck, subscription agreements, or investment standards. Some of these things could also be covered by including particular team members; for example, hiring an asset manager or third-party asset management firm.

[More from Thomson: Investing Predictions]

In conclusion

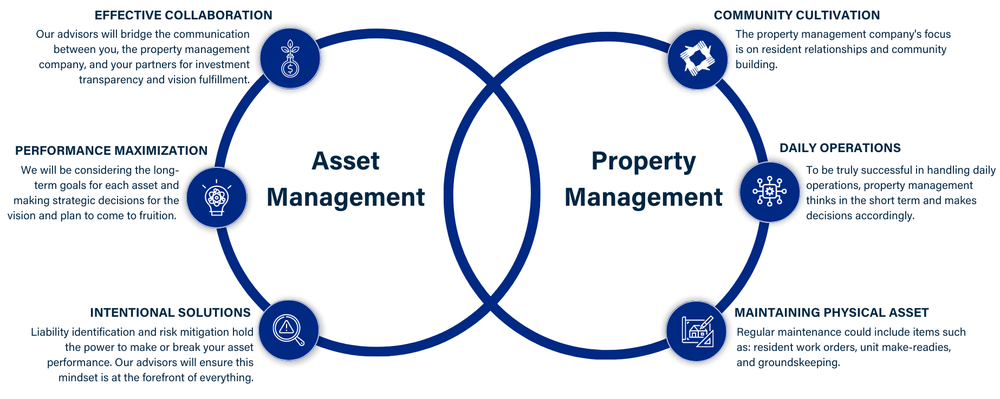

Asset management is vastly different from, but works in collaboration with, property management, and without fulfilling those roles it has the power to turn a good property into a bad investment. However, as long as each asset sets a mission, determines a vision, curates a plan, practices regular accountability through KPIs, and communicates with its investors, it is satisfying a large majority of the necessary actions associated with successful asset management.

About Sean Thomson

Over the last decade, Sean Thomson has been perfecting his processes of scouting, acquiring, and investing in real estate. He founded Thomson Multifamily Group to allow interested, accredited, and sophisticated investors to partake in the investment opportunities that he develops throughout the country.

Sean also realized the biggest risk to his investments and his investors’ interest is how well he manages his assets. He cofounded Union Asset Advisors to bring an institutional quality asset management system to independent multifamily owners nationwide.

Thomson Multifamily Group is not an affiliate of Equity Trust Company. Opinions or ideas expressed by Thomson Multifamily Group, their affiliates, and employees are not those of Equity Trust Company nor do they reflect their views or endorsement. This material is for educational purposes only, and should not be construed as tax, legal, or investment advice. Equity Trust Company is a directed custodian and does not provide tax, legal, or investment advice. Investing involves risk, including possible loss of principal. Whenever making an investment decision, please consult with your tax attorney or financial professional.