Become a

Smarter

Investor

in 15 Minutes

Free guide helps you unlock the potential

of your retirement account

– all before you

finish a cup of coffee.

Investor Insights Blog|Traditional IRA vs. Roth IRA: Frequently Asked Questions

Tax-Advantaged Accounts

Individuals often face a variety of questions as they explore the different types of retirement accounts and consider their options. How do you know which will be best for you?

Understanding the similarities and differences between a Traditional IRA and a Roth IRA can help you decide which individual retirement account may be best for you as you plan and save for retirement.

To help you better understand how a Roth IRA and Traditional IRA compare, review a few of the most commonly asked questions.

Roth IRA – Generally, if you receive taxable compensation in a given year, you may make an out-of-pocket contribution to a Roth IRA as long as you fall within the income restrictions outlined by the IRS and discussed below.

Traditional IRA – Generally, you may make an out-of-pocket contribution to a Traditional IRA if you receive taxable compensation.

Note: As outlined in IRS Publication 590-A, taxable compensation for the purposes of an IRA includes wages, salaries, commissions, net income from self-employment, etc. It does not include earnings and profits from property, interest and dividend income, pension or annuity income, etc.

Roth IRA – The IRS sets modified adjusted gross income (MAGI) limits each year that dictate eligibility for Roth IRA contributions. The limits depend on your filing status and determine if you are eligible for a full or partial contribution, or if you are ineligible to contribute to a Roth IRA that year (2023 MAGI limits).

Traditional IRA – There are no income limitations to contribute to a Traditional IRA.

Note: The amount you can contribute in a given year cannot exceed the yearly contribution limits set by the IRS or the amount of your taxable compensation earned in the year you are contributing.

Traditional IRA & Roth IRA – You can contribute at any age as long as you have earned income.

Traditional and Roth IRA contribution limits are outlined below. As discussed earlier, Roth IRA contribution limits may be lower based on your earned income.

Traditional IRA & Roth IRA– For 2024, if you’re under age 50, you can contribute up to $7,000. If you’re age 50 or older, you can contribute up to $8,000.

Note: The annual contribution limits set by the IRS are for total contributions to all of your Traditional and Roth IRAs, combined, and contributions cannot be more than your taxable compensation for the year.

Video: What is the Difference Between a Traditional IRA and a Roth IRA?

According to the IRS, you can contribute to an IRA (Traditional and/or Roth) even if you participate in an employer-sponsored plan, including a SEP or SIMPLE IRA plan.

The deadline for contributing to both a Traditional and Roth IRA is the tax filing deadline for the year of the contribution. The deadline to contribute for the 2023 tax year is April 15, 2024.

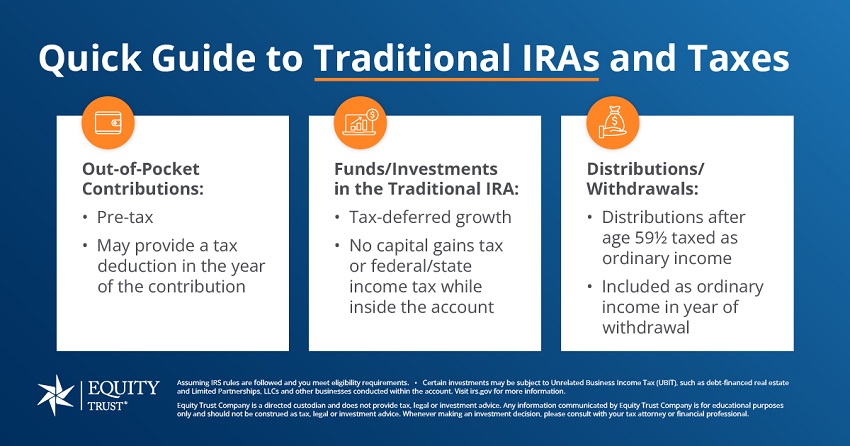

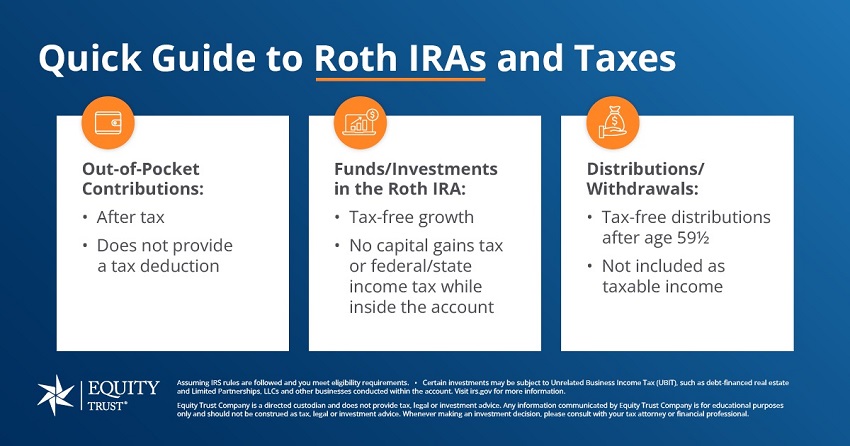

Roth IRA – You cannot deduct your Roth IRA contributions because contributions to a Roth IRA are made with after-tax dollars.

Traditional IRA – You may be able to deduct a portion or all of your Traditional IRA contributions. The IRS outlines the deduction allowances according to your income range and filing status, depending on whether either you and/or your spouse are covered by a retirement plan at work.

In addition to out-of-pocket contributions, which require taxable compensation and are subject to annual contribution limits, you may also have the potential to fund an IRA from an existing retirement plan through a transfer or rollover.

Transfers and rollovers are not subject to contribution limits or taxable compensation requirements.

An IRA transfer is when you move funds or assets from an existing IRA to a new IRA of the same type at another financial institution (i.e. Traditional IRA → Traditional IRA or Roth IRA → Roth IRA).

It’s possible to complete a full or partial transfer and it may also be possible to transfer existing assets your IRA holds, in addition to cash balances.

A rollover involves moving funds from a qualified plan, such as a 401(k), 403(b), Thrift Savings Plan or other qualified plan, to an IRA.

A rollover typically occurs when the account owner receives a personal distribution from their previous employer or current provider of their plan. After receiving the distribution, the account owner has 60 days to deposit, or “roll over,” the funds into a new account.

As with transfers, it’s possible to do a full or partial rollover and may be possible to rollover cash and/or assets.

Video: Transfers & Rollovers

Roth IRA – There are no RMD requirements for Roth IRAs, which is one of the potential benefits of a Roth IRA.

Traditional IRA – You are required to take your first distribution from by April 1 of the following year you reach age 73. You will be required to complete a distribution by December 31, every year thereafter.

Roth IRA – Early distribution of any earnings before age 59½ may be included in gross income for that year and subject to ordinary income tax, plus a 10-percent penalty.

However, since you’ve already paid taxes on contributions to your Roth IRA, you may withdraw your regular contributions at any time/age.

After you withdraw the amount equal to the balance of your regular contributions, the earnings will be taxable if the distribution isn’t qualified. It’s important to note that all of your IRAs (if you have more than one) are treated as one for withdrawal purposes.

Traditional IRA – Early withdrawal from a Traditional IRA prior to age 59½ is included in gross income for that year and is subject to ordinary income tax, plus a 10-percent penalty.

Note: There are some exceptions to the 10-percent penalty.

Roth IRA and Traditional IRA – With a self-directed custodian, such as Equity Trust, you have the ability and option to invest in alternative assets such as real estate, private equity, cryptocurrency (i.e. Bitcoin), promissory notes, precious metals, and many others, in addition to traditional assets like stocks, bonds, and mutual funds.

Video: Self-Directed Roth IRA FAQs

Am I eligible to make a contribution? How much can I contribute?

Do transfer funds from a previously established IRA have to be from like accounts?

How do I set up a self-directed retirement account?

Sources:

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue