Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Investor Insights Blog|Wall Street Journal Shines Light on Self-Directed Real Estate Investors and a Fix-and-Flip Hot Spot

Real Estate

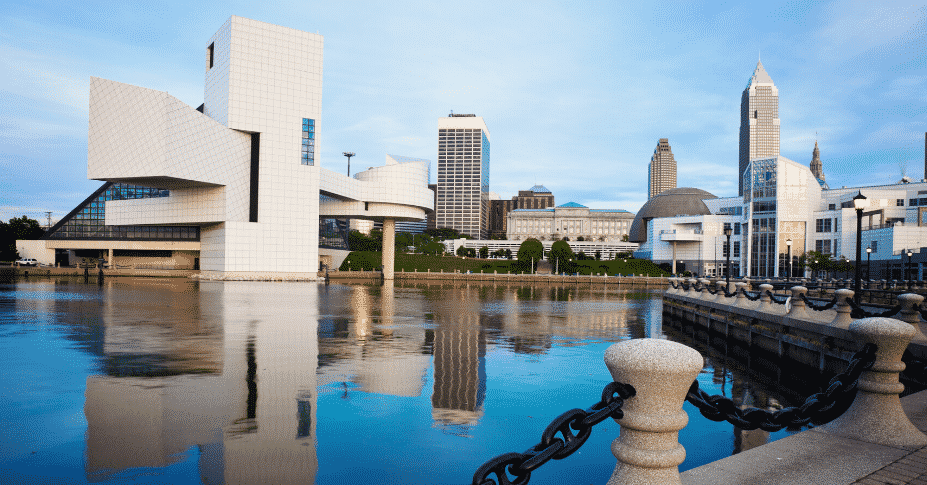

In a recent Wall Street Journal article*, “Cleveland Is a House-Flipping Hot Spot, and Covid Adds Fuel,” Ryan Dezember explains why real estate investors seem to be moving away from the Sunbelt to lower-priced areas, such as Cleveland.

Homeownership is at risk due to the financial crisis stemming from the recent pandemic, especially for certain groups like millennials, potentially presenting an opportunity for real estate investors to leverage rental properties.

“That’s where Cleveland comes in,” states Dezember. Equity Trust is headquartered in Westlake, Ohio, which is only about 18 miles west of downtown Cleveland.

Cleveland is viewed as a profitable area in the U.S. to fix and flip properties specifically, a strategy used by many investors who invest in real estate in their self-directed IRA. Dezember says the typical fix-and-flip deal done in the Cleveland area, as well as other cities around the Great Lakes, sells for double the cost, which is a big differentiator from the Sunbelt area.

Individuals often buy rentals with self-directed individual retirement accounts, which allow savers to diversify beyond stocks and bonds.

Ryan Dezember, The Wall Street Journal

“California property-investment adviser Kathy Fettke steers clients clear of the Sunbelt cities where Wall Street gobbles up houses and surging prices have squeezed margins, guiding them instead to northeastern Ohio,” states Dezember.

According to Zillow.com’s home value index, the median home value in Cleveland is a little over $68,000. The median home value for the state of Ohio is about $153,500. Compare this to California as a whole ($578,200), or even Sacramento ($362,000).

“Mortgage delinquencies doubled between March and April to nearly 3.4 million, according to Black Knight Inc. That could put more foreclosed homes on the market for investors,” says Dezember.

[Read more: Where Equity Trust clients are using their IRAs to purchase out-of-state properties]

Whether investors are in Cleveland, or other housing markets impacted by COVID, a self-directed IRA allows individuals to use their retirement funds to invest in properties, such as fix-and-flips, apartment buildings, and more.

Not only do investors have the option to purchase property with a self-directed account, it’s possible to lend money for these types of investments to real estate companies, startups, LLCs and more.

“The Retirement Industry Trust Association says $5.6 billion of IRA money is invested in property and an additional $27.7 billion with limited liability companies, which usually own income-generating real estate. The spending power is even greater considering lenders will finance most of the purchase price,” he says.

If I invested in a rental property with my IRA, how does the rental income get into my account?

Can I roll over a 401(k) account into a self-directed IRA?

What are prohibited transactions in an IRA?

*Subscription required to view article.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue