Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Investor Insights Blog|Roth IRA Conversions: What is a Backdoor Roth IRA?

Roth IRA

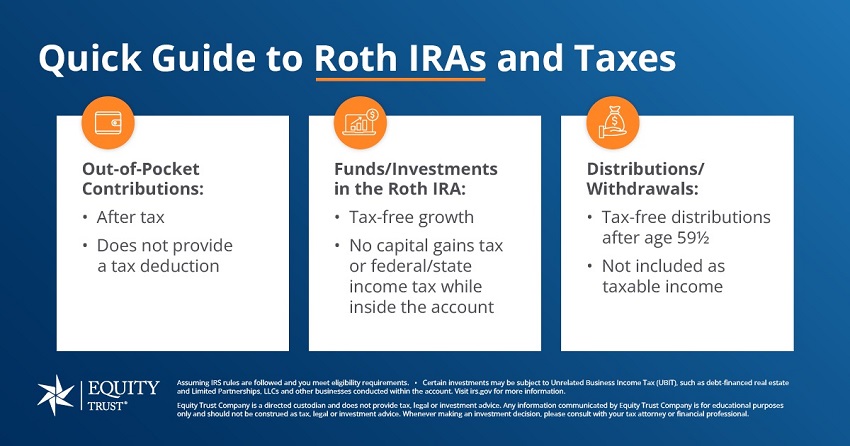

Are you thinking about converting your Traditional IRA or 401(k) to a Roth IRA or wondering if the move is right for you? It’s important to understand what a Roth conversion is, how it works, the rules associated with it and the possible tax implications before you decide.

A Roth IRA conversion is a strategy to potentially maximize tax-free retirement savings by moving money to a Roth IRA.

Essentially, a Roth conversion is a process of converting cash and/or assets from a Traditional IRA, SEP IRA, 401(k) or other tax-deferred retirement plan to the tax-free environment of a Roth IRA.

Since Roth IRAs weren’t available until 1998, a Roth conversion is a strategy many individuals use to transition their existing tax-deferred retirement savings to tax-free savings in a Roth.

According to Forbes, “If you believe that income tax rates will increase in the future – as many finance and tax experts do – then you will agree that the Roth IRA is often a better choice than the traditional IRA, if the objective is to choose the one that results in the lower income tax.”

It’s important to note that a Roth IRA conversion is a taxable event and will impact your taxable income the year you convert, so be sure to consult and plan with a financial professional. Just as Roth IRA contributions are not tax-deductible, any funds converted from a traditional IRA to a Roth IRA are also included in your ordinary income and taxed as such.

A “backdoor Roth IRA” is a potential way for those who don’t qualify for Roth IRA contributions to still be able to convert their retirement account to a Roth and enjoy the tax-free status.

In other words, those who surpass the income requirements for contributing to a Roth IRA may still be able to have an account.

Hypothetical example 1: Your income exceeds the modified adjusted gross income (MAGI) limits to be eligible to contribute to a Roth IRA. You could potentially contribute to a traditional IRA and then convert the funds to a Roth IRA (sometimes known as the backdoor Roth IRA).

For this example, let’s say you contribute $6,000 to a traditional IRA for the year. But, instead of leaving it in the traditional IRA and receiving a potential tax deduction, you instead convert the $6,000 contribution to a Roth IRA in the same tax year.

The net effect of the backdoor Roth IRA contribution is that the conversion eliminates the ability to make deductible IRA contributions. Any potential tax deductions from the traditional IRA contribution and the $6,000 remains in your taxable income for the year.

Except now, it’s in your Roth IRA to grow tax-free.

Hypothetical example 2: You have $100,000 in a tax-deferred 401(k) from a previous employer. You want to fund a Roth IRA with a conversion of $50,000 and have a 20-percent effective tax rate. How would this potentially work?

First, you would establish a traditional IRA with a custodian such as Equity Trust Company. Once the traditional IRA is established, you are able to roll over $50,000 from your 401(k) to the traditional IRA.

Then, you would establish a Roth IRA as the destination for the converted funds and would facilitate the conversion from the Traditional IRA your Roth IRA. You then could close the traditional IRA if you wish.

As you can see in this example, you aren’t required to convert the entire account and have the option to choose a partial Roth conversion in an amount that makes sense for you.

You may also conduct multiple partial conversions throughout a given tax year or over a series of many years. Please consult with a tax or financial professional to discuss your options.

Video: How to Make a Backdoor Roth IRA Contribution

In the second hypothetical example, the $50,000 you are converting from the Traditional IRA to your Roth IRA would be added to your ordinary income in the year of the conversion and taxed at your ordinary income tax rate. Because of this, it’s important to consult and plan with a tax professional because a Roth conversion will increase your taxable income for the year, potentially resulting in a higher tax bracket.

With a 20-percent effective tax rate, you would owe $10,000 in taxes on the converted funds for this example.

It’s possible to pay the tax from the converted funds, thus reducing the amount moving to your backdoor Roth IRA to $40,000 for the above example. However, some investors decide to convert the full amount and pay the tax out-of-pocket to maximize the amount of tax-free Roth IRA dollars available to invest and compound tax-free.

Continuing this example: if you chose to pay the tax out-of-pocket, you would have $50,000 in your newly established Roth IRA, after the conversion, available to invest.

It may be difficult to weigh the present cost of a Roth conversion and accept the tax hit today without any concept of the potential benefits in the future. One helpful way to conceptualize a decision 10, 20 or even 40 years down the road is to utilize a Roth IRA Conversion Calculator, which we used in our video breakdown of a Roth IRA conversion example:

[Watch: Roth IRA Conversion Calculation]

With a self-directed Roth IRA at Equity Trust, you have the freedom to invest your Roth IRA in real estate, notes, private equity, precious metals, cryptocurrency and a wide variety of alternative assets, in addition to stocks, bonds and mutual funds in your tax-free account.

Understanding how a conversion works is the first step to considering the option of a backdoor Roth IRA. Evaluating a Roth conversion means assessing where you are today compared to where you may be in the future.

Remember, since it is a taxable event, it’s important to consult with your financial advisor or a tax professional before deciding next steps.

Two Equity Trust clients rolled over their 401(k)s to traditional IRAs at Equity Trust. The couple were both real estate investors and were confident they could achieve a solid return in their IRAs through real estate investing.

They each converted to a Roth IRA and started with approximately $100,000 between both accounts. Fast forward less than ten years, and they’ve grown their Roth IRAs to over $1 million and have 13 rental properties between both accounts.

Their rental properties are generating nearly $110,000 in tax-free cash flow each year.

Since they have both reached age 59½, they’re able to take tax-free distributions from the cash flow in their accounts. They can also continue holding the properties and investing without worrying about a traditional IRA’s required minimum distributions (RMDs).

Today, that tax-free cash flow can be traced back to their decisions in 2010 to execute Roth IRA conversions.

They now have the ability to fund their retirement years with their tax-free investment income, can cash out tax-free by selling the properties or have the option to leave a portfolio of tax-free, cash-flowing properties to their children, grandchildren or whoever is the beneficiary of their accounts.

There are generally three ways to convert funds from a traditional IRA to a Roth IRA.

According to the IRS, you can:

The deadline to complete a Roth conversion is December 31 of each tax year.

[Related: What is the Roth IRA 5-Year Rule?]

Am I required to transfer my entire account?

Do transfer funds from a previously established IRA have to be from like accounts?

Interested in learning more or have questions?

To get a better understanding of the Roth IRA specifically, download our complimentary Roth IRA Guide:

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue