Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Investor Insights Blog|Is the 60/40 Portfolio Still Relevant?

Self-Directed IRA Concepts

In the ever-evolving landscape of investment strategies, one of the longstanding approaches has been the 60/40 portfolio. But as markets change, some investors are seeking alternative concepts to save for retirement. Let’s dive into what the 60/40 portfolio entails, its potential shortcomings, and the emerging alternatives in the modern investment world.

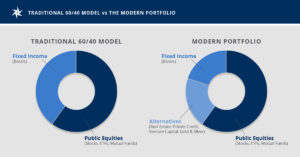

The 60/40 portfolio is an investment strategy that allocates 60% of the portfolio to equities (stocks) and 40% to fixed-income investments (bonds). This mix aims to balance the growth potential of stocks with the stability and income generation of bonds. The rationale behind this allocation is to achieve a diversified portfolio that can weather various market conditions.

While the 60/40 portfolio has been a popular strategy for decades, some investors are turning away from it. Here are some of the reasons:

The modern portfolio, often referred to as a more diversified or alternative portfolio, seeks to address these potential shortcomings by including a broader range of asset classes. Instead of splitting a portfolio between only public equities and fixed-income bonds, the portfolio expands to incorporate assets such as real estate, commodities, private equity, and other private or alternative investments.

The idea is to enhance diversification and potentially increase returns while varying risk.

Reasons an investor might seek out a diversified, modern portfolio instead of a 60/40 stocks/bonds portfolio include:

It’s important to consult with your financial advisor before making any portfolio moves. If you decide to move ahead with alternative investments, there are ways you can evaluate potential investments for suitability.

BlackRock recommends looking at the “three Ds” of an investment:

Of course, it’s recommended to regularly review and adjust your portfolio to align with your financial goals, risk tolerance, and market conditions.

Creating a modern portfolio has become increasingly more accessible to the average investor. Private market investing, once limited to institutional investors and high-net-worth individuals, is becoming more popular,

One way to invest in alternatives is with a self-directed IRAs (SDIRA), which allows investors to hold a variety of alternative investments within their retirement account. An SDIRA provides investors with the flexibility to diversify their retirement portfolios beyond traditional stocks and bonds, potentially enhancing returns and managing risks more effectively.

At Equity Trust, IRA investors have access to an array of alternative investments through our WealthBridge portal – which integrates with investment platforms – and Investment District online marketplace – which provides links to dozens of asset providers offering a variety of investment types.

For more information on the modern portfolio approach and diversification options for retirement accounts, watch our on-demand webinar, “Diversifying Beyond the Stock Market: How to Get Started.”

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue