Nearly Limitless Options

in One IRA

Invest in both traditional and alternative assets with a single custodian – ready to go beyond a self-directed IRA?

If you are a former Midland Trust client, please click here to log in to your account. Looking for account resources? Click here.

Have a question about your Equity Trust Company annual billing? Below you’ll find the answers to the most commonly asked questions about our fee schedules, billing process, invoice payments, and more.

Annual Maintenance Fees are typically billed in the first quarter of the year. Invoices are mailed to account holders that are not enrolled in Autopay, or whose Autopay could not be processed. Fee payments are due by the designated due date on the invoice. If the payment is not received by the due date, a late fee will be assessed.

Equity Trust will begin mailing Annual Maintenance Fee bills in mid-January, and the due date for the 2025 AMF invoice is Friday, March 28, 2025.

Equity Trust provides multiple payment options:

If you would like to have your annual fees automatically debited on the invoice date from your Equity Trust account’s available cash balance or credit card on file, you can enroll in Autopay.

•Click here to enroll in Autopay. Please complete by December 31, 2024 to ensure a seamless billing process.

•Your account must have a sufficient cash balance or valid credit card at the time of billing

Fees can be paid from available cash in your Equity Trust account or by credit card. To pay fees using one of these methods, follow the instructions below.

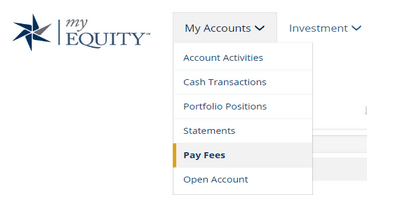

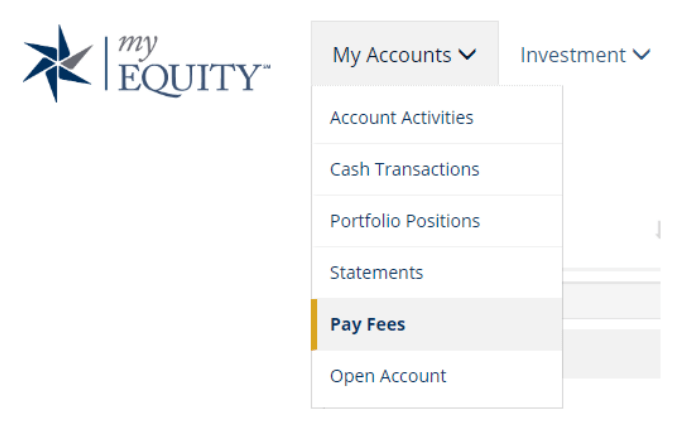

a) Log into myEQUITY

For more information on enrolling in myEQUITY, click here.

b) Click on the “My Accounts” Menu and click Pay Fees

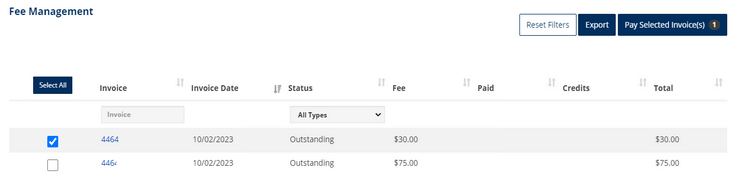

c) Select the invoice(s) you would like to pay. Click Pay Selected Invoice(s)

d) Select the Payment Method – Select to add a new credit card, use an existing one on file, or deduct from your account’s cash balance.

e) Click continue to submit the request to process the fee payment.

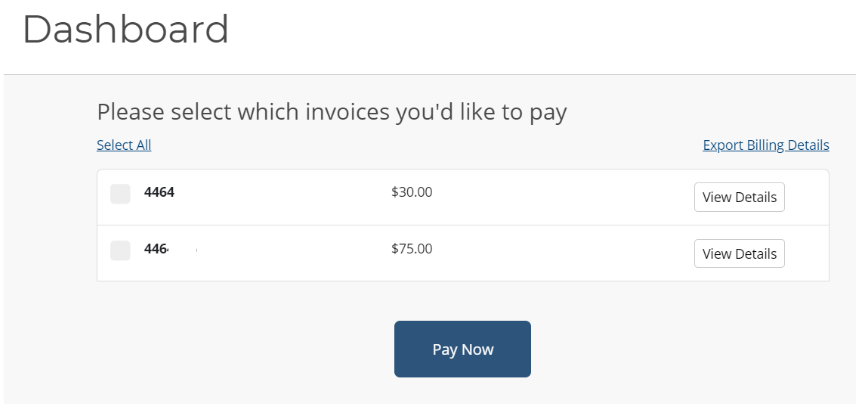

a) Go to: https://info.trustetc.com/fee-payment

b) Enter your Equity Trust Account Number and Billing Zip Code

c) Select the invoice(s) you would like to pay. Click Pay Now

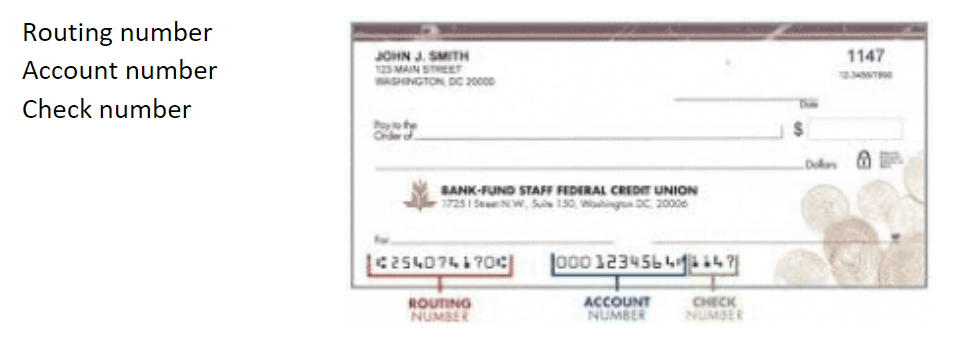

d) Enter the bank information

When you elect to pay your invoice via ACH, you’ll need information about your bank account, which can be found at the bottom of a check associated with the account (see image below):

e) Confirm Payment Instructions

f) Save your Receipt

a) Call our automated payment system at 877-833-0927 to pay your invoice via ACH (checking or savings account) or with a credit card.

b) Provide your account number and billing address zip code to access your unpaid invoices.

c) Enter your payment details, whether it’s your routing and bank account numbers or credit card information.

d) Please note that you will need to repeat this process for each invoice, as only one invoice can be paid per call. For example, if you owe an Annual Maintenance Fee and a Paper Statement Fee, you will need to call the automated system two separate times to pay two separate invoices.

For fee schedules that are market value based, your Annual Maintenance Fee is based on the total market value of your account as of the last business day of the year and billed according to the Equity Trust fee schedule assigned to your account.

Click on the fee schedule based on your account type:

If you have a prior fee arrangement with an external third party, please confirm payment details with the appropriate party directly.

For market-value based fee schedules, the account value used to calculate your Annual Maintenance Fee is determined by the account’s total market value as of the last business day of the year. For values to be updated by this date, Fair Market Valuation Forms must have been received by December 15.

For future fees to have accurate values prior to being assessed, please be sure to submit these valuation forms and supporting documentation as early as possible. Fair Market Valuation activities can be submitted in myEQUITY. To view a video about Fair Market Valuations, click here.

To access the Fair Market Valuation Forms:

For more information on enrolling in myEQUITY, click here.

A Paper Statement Fee is charged to accounts that have elected to receive quarterly statements through the mail, opposed to electronic delivery.

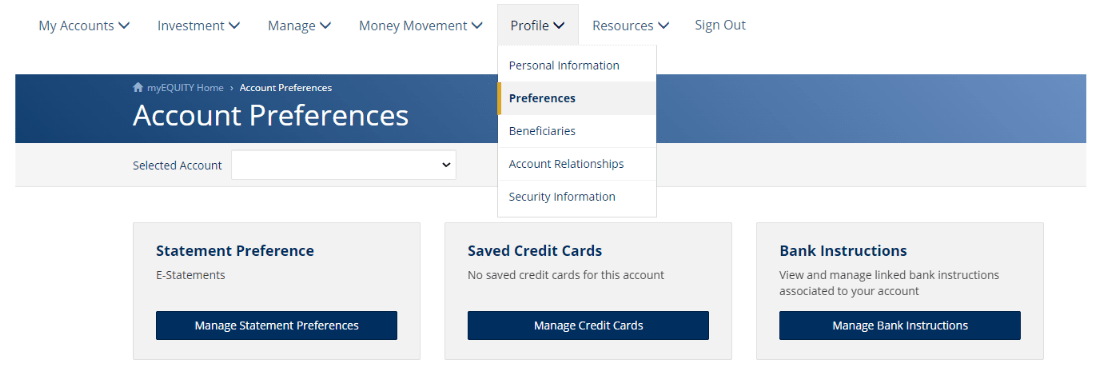

If you would prefer to receive eStatements and eliminate the fee for receiving paper statements, follow the below steps to update your statement preference in myEQUITY.

For more information on enrolling in myEQUITY, click here.

** What if the email address shown on the page is incorrect? **

– Click on Profile > Personal Information

– Click on Update Email Address

– Complete the MFA Authentication by entering the code

– Replace the current email address with your new information, click Submit.

Equity Trust will attempt to deduct the outstanding fee from your account’s available cash balance or charge to a credit card on file following the due date shown on the invoice. If unsuccessful, you will be mailed an invoice indicating the late fee and the account’s unpaid maintenance fee balance. Equity Trust may charge up to two late fees per year, not to exceed $100.00.

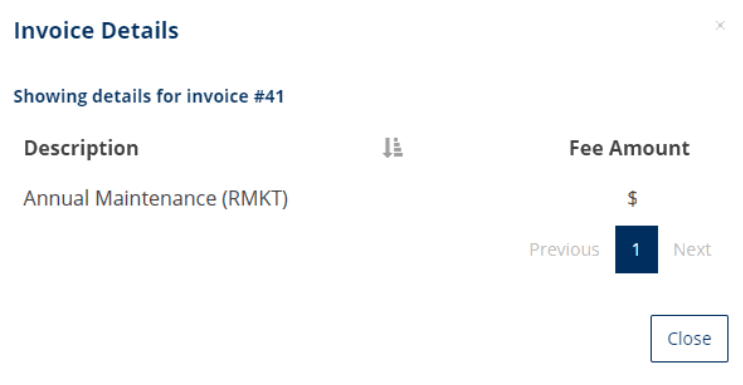

You can check your account for any invoiced fees within myEQUITY.

For more information on enrolling in myEQUITY, click here.

To change your account’s payment preferences, follow the steps outlined here.

** If updating your preference to a credit card, be sure that the credit card is already saved to your account within myEQUITY (Profile > Preferences > Saved Credit Cards) and provide the last 4 digits of the card in the email request. **

If you have questions about your fee assessment, please send an email to [email protected].

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue